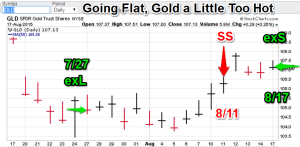

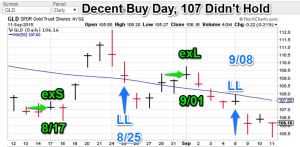

Model Notes: Both models are behaving well. The US dollar broke south at the end of the week, after selling on Tuesday. The gold model issued a buy on 9/08 (after the close), so the purchase day would be 9/09 (closing price was 106.13, GLD basis), Friday’s close was almost identical. The upcoming week will give us a better sense of whether this is a low or not.

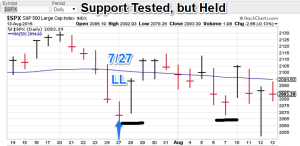

Featured market rotation: Equities for August, US Dollar for September and Bonds for October. Japanese yen for November. Brazilian real for December. Gold is currently non-rotational.

Model Portfolios: Gold = Buy 9/08, USD = Exit Long 9/08

Nonlinear Trading Themes:

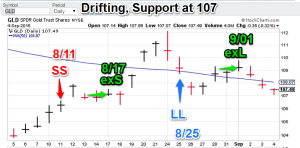

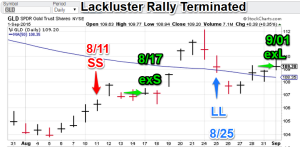

Gold: GLD pierced the 107 level (bad) but managed to hold after the drop day 9/09 the rest of the week (good for bulls) drifted down to find support at the 107 level. Readings are still supportive. The model gold portfolio remains long.

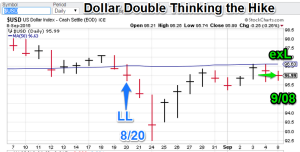

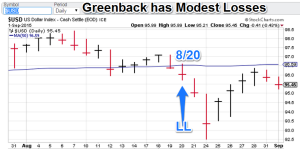

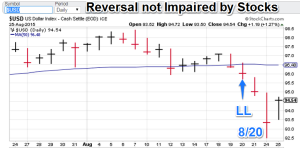

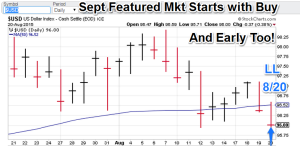

Gold: GLD pierced the 107 level (bad) but managed to hold after the drop day 9/09 the rest of the week (good for bulls) drifted down to find support at the 107 level. Readings are still supportive. The model gold portfolio remains long. US Dollar (Sept Featured Market): The greenback staggered during the closing trades of the week. Dollar bulls flinched after looking into ‘don’t rock the boat’ Yellan’s eyes for any sign of stern resolve to raise rates on the back of World Bank criticism. US Dollar portfolio remains flat.

US Dollar (Sept Featured Market): The greenback staggered during the closing trades of the week. Dollar bulls flinched after looking into ‘don’t rock the boat’ Yellan’s eyes for any sign of stern resolve to raise rates on the back of World Bank criticism. US Dollar portfolio remains flat.

Note: Technical analysis comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Forex Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as the Bond trading signals. Currently available.

- We now offer S&P 500 signals (along with the choppy $VIX). This index is a mainstay among financial participants and traders around the world. Sign-up for exclusive signals to give you the edge. Currently available.

GH Garrett – Veteran Commodity Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”