Model Notes: The models are preforming well. Both gold and the US dollar results seem to hint the Fed is going to delay the rate hike.

Featured market rotation: Equities for August, US Dollar for September and Bonds for October. Japanese yen for November. Brazilian real for December. Gold is non-rotational.

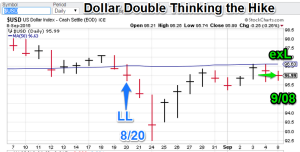

Model Portfolios: Gold = Buy 9/08, USD = Exit Long 9/08

Nonlinear Trading Themes:

Gold: GLD drifted down to find support at the 107 level. The readings suggest the next move will be up, (probably on a delay by the Fed). The model gold portfolio moves long today.

Gold: GLD drifted down to find support at the 107 level. The readings suggest the next move will be up, (probably on a delay by the Fed). The model gold portfolio moves long today. US Dollar (Sept Featured Market): The dollar failed to break north of the 96.50 level. The World Bank chief economist, Kaushik Basu (who?), warned of global problems if the Fed raises rates. Americans are not particularly fond of advice from foreign institutions but Yellan seems to have a strain of ‘don’t rock the boat’ in her and the dollar bulls are rethinking the likelihood of a near-term hike. US Dollar portfolio is flat (exit long) as of today’s data.

US Dollar (Sept Featured Market): The dollar failed to break north of the 96.50 level. The World Bank chief economist, Kaushik Basu (who?), warned of global problems if the Fed raises rates. Americans are not particularly fond of advice from foreign institutions but Yellan seems to have a strain of ‘don’t rock the boat’ in her and the dollar bulls are rethinking the likelihood of a near-term hike. US Dollar portfolio is flat (exit long) as of today’s data.

Note: Technical analysis comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as the Bond trading signals. Currently available.

- We now offer S&P 500 signals (along with the choppy $VIX). This index is a mainstay among financial participants and traders around the world. Sign-up for exclusive signals to give you the edge. Currently available.

GH Garrett – Veteran Commodity Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”