System Notes: The equity meltdown we are experiencing is a type of ‘black swan’ event . So how did the models do? Gold did the best as the yellow metal model was flat before the event. Equities were caught on the wrong side of the move, destroying a mostly positive (i.e. most of the days were north of the buy signal) August. Oh well. I am removing the VIX chart for the rest of the month as I have added the upcoming USD chart. I will post the signals for VIX for the rest of the month, just not produce a chart to show them.

Featured market rotation: Equities for August, US Dollar for September and Bonds for October. Gold is non-rotational. Starting USD early!

Model Portfolios: Gold = Buy 8/25, S&P 500= Neutral 8/25, VIX=Neutral 8/25, USD = Buy 8/20

Nonlinear Trading Themes:

Gold: The yellow metal now goes on a buy. The effect is a counter trend buy against a longer term uptrend. The model gold portfolio signals long today.

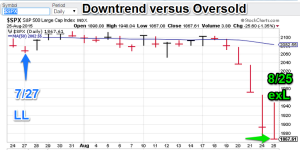

Gold: The yellow metal now goes on a buy. The effect is a counter trend buy against a longer term uptrend. The model gold portfolio signals long today. S&P 500 (August Featured Market): Largecaps have just died since Tuesday. The model goes flat today as the market is now both in a technical downtrend yet at the same time oversold. The combination of western over indebtedness and Chinese deceleration have put stocks in a very precarious situation. Tuesday’s failed rally is also disturbing sign of weakness. The S&P 500 portfolio is now flat.

S&P 500 (August Featured Market): Largecaps have just died since Tuesday. The model goes flat today as the market is now both in a technical downtrend yet at the same time oversold. The combination of western over indebtedness and Chinese deceleration have put stocks in a very precarious situation. Tuesday’s failed rally is also disturbing sign of weakness. The S&P 500 portfolio is now flat.- $VIX (S&P volatility) (August Featured Market): Our model was also on the wrong side of the volatility spike. The VIX portfolio is now flat.

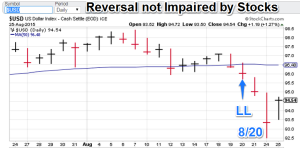

US Dollar (Sept Featured Market): The US dollar index buy came amidst the equity meltdown. The model picked up the buy on Aug 20th. Prices moved lower on the following two days but Tuesday’s reversal is still intact. It is not inconceivable buyers will come into the dollar against a backdrop of global fear. US Dollar portfolio is still bullish.

US Dollar (Sept Featured Market): The US dollar index buy came amidst the equity meltdown. The model picked up the buy on Aug 20th. Prices moved lower on the following two days but Tuesday’s reversal is still intact. It is not inconceivable buyers will come into the dollar against a backdrop of global fear. US Dollar portfolio is still bullish.

Note: Technical analysis comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as the Bond trading signals. Currently available.

- We now offer S&P 500 signals (along with the choppy $VIX). This index is a mainstay among financial participants and traders around the world. Sign-up for exclusive signals to give you the edge. Currently available.

GH Garrett – Veteran Commodity Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”