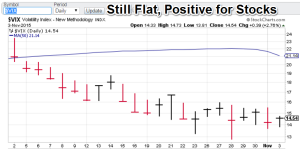

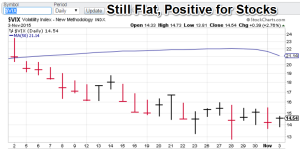

Model Notes: Both the gold and real signals were not helped by the terror attack in San Bernardino, so we are looking for the true future trend and how we can get in sync with it. Gold spiked up after the attack but the Dec 3 moved helped us with a higher sell level (TSP), The Dec 4 strength did hurt the signal but there was limited follow through. We are not that far out of the money, we will have to let this one go further. The real moved against us immediately after the attack as well. The initial weakness was good for the entry signal but subsequent weakness was not. The last two days the market found some strength

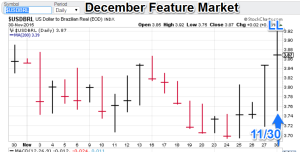

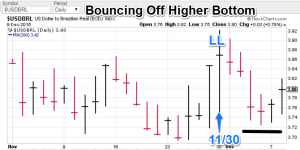

Featured market rotation: .Brazilian real for December (hello). S&P for January. Gold is currently non-rotational.

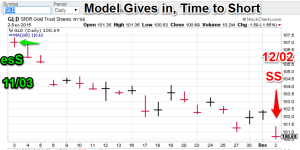

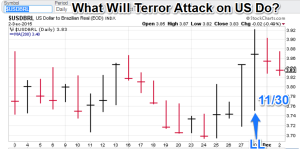

Model Portfolio Signals: (Gold) sell signal = 12/02 (TSP=101.76), The Brazilian real long signal 11/30 (TSP=3.853).

Note: TSP is calculated by using the closing price of the trading day after the signal day.

Nonlinear Trading Themes:

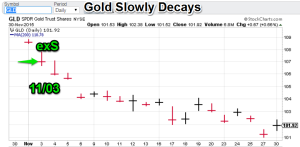

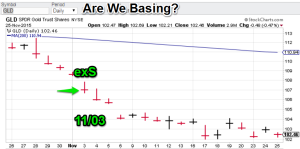

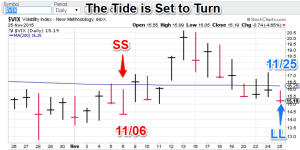

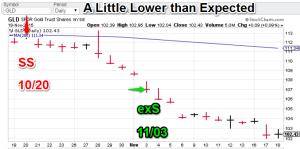

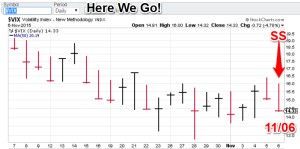

Gold: Gold lost buying pressure after the Dec 4 spike. GLD failed to pierce the recent high established on Nov 19 (104, GLD basis). I think the fund would have closed negative today, if not for the latter day strength in stocks. Anyway the last two day’s action in more negative than positive. We are only about a point away from the TSP. The model gold portfolio is remains short.

Gold: Gold lost buying pressure after the Dec 4 spike. GLD failed to pierce the recent high established on Nov 19 (104, GLD basis). I think the fund would have closed negative today, if not for the latter day strength in stocks. Anyway the last two day’s action in more negative than positive. We are only about a point away from the TSP. The model gold portfolio is remains short. Brazilian Real (Dec. Featured Market): The real got his in the aftermath of the attack news however the strength of the las two days has formed short term bottom that is a little higher than the previous one (3.72 versus 3.70). Technically, we should see some additional strength on the short-term The real model remains long.

Brazilian Real (Dec. Featured Market): The real got his in the aftermath of the attack news however the strength of the las two days has formed short term bottom that is a little higher than the previous one (3.72 versus 3.70). Technically, we should see some additional strength on the short-term The real model remains long.

Note: Non linear trading theme comments are based on interpretations of non-linear trading models, combined with chart price action (technical analysis)..

Premium offers:

- I am now offering a more a la carte fee system for CTM research. Purchasers can now mix and match signals on various symbols that are currently available. Click on the ‘Fees’ tab for more info.

- With deflationary forces becoming more dominant, top level, successful, investment strategies are going to become more reliant on ‘activity’ (trading). Check out ConquerTheMummy.com for trading signals that help!

- Remember: Nonlinear trading analysis is “insider knowledge” (non-apparent) for standard technical analysis.

- The post-mortems for the recent US dollar and the VIX (NEW) featured markets have been posted. To view it select the “Forex” or “US Equity” tabs (respectively) on ConquerTheMummy.com.

GH Garrett – Veteran Market Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”