Model Notes: The VIX buy signal occurs after a trading day where the close is below the selling TSP. Comparing the November 27 close to the previous TSP of November 09 will tell the tale as whether this is a win or not. On the gold side, the exit short signal has been constructive as it has positioned us to a neutral position during relatively flat market action against a backdrop of an unexpected and sizable terror attack against a major western country. The models are keeping pace. By the way, the Conquer the Mummy website wishes a Happy Thanksgiving to our readers and advises to take a moment to look higher!

Featured market rotation: VIX for November (looking for a starting signal now). Brazilian real for December. S&P for January. Gold is currently non-rotational.

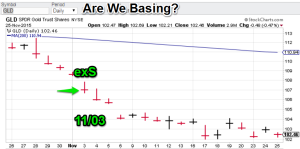

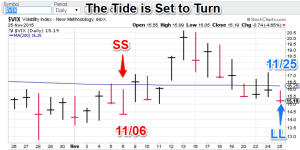

Model Portfolio Signals: (Gold) Flat Signal= 11/03 (TSP=105.97), (VIX) Buy=11/25 (TSP=Waiting)

Note: TSP is calculated by using the closing price of the trading day after the signal day.

Nonlinear Trading Themes:

Gold: GLD seems to be holding at the 102 level for now. I have some evidence we are approaching an entry signal in the next 5 trading days. But we are not there yet. The model gold portfolio signal is still flat.

Gold: GLD seems to be holding at the 102 level for now. I have some evidence we are approaching an entry signal in the next 5 trading days. But we are not there yet. The model gold portfolio signal is still flat. VIX (Nov. Featured Market): Largecaps held up well in the aftermath of the Paris attacks but recent trading appears to have the bulls stalling out. The VIX models are now signaling more upside for volatility. Will there be more attacks during the important Christmas shopping season? I hope not but the modes suggest there is increasing risk. The model VIX portfolio is now long.

VIX (Nov. Featured Market): Largecaps held up well in the aftermath of the Paris attacks but recent trading appears to have the bulls stalling out. The VIX models are now signaling more upside for volatility. Will there be more attacks during the important Christmas shopping season? I hope not but the modes suggest there is increasing risk. The model VIX portfolio is now long.

Note: Technical analysis comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- I am now offering a more a la carte fee system for CTM research. Purchasers can now mix and match signals on various symbols that are currently available. Click on the ‘Fees’ tab for more info.

- With deflationary forces becoming more dominant, top level, successful, investment strategies are going to become more reliant on ‘activity’ (trading). Check out ConquerTheMummy.com for trading signals that help!

- Remember: Nonlinear trading analysis is “insider knowledge” (non-apparent) for standard technical analysis.

- The post-mortem for the US dollar has been posted. To view it select the “Forex” tab on ConquerTheMummy.com.

GH Garrett – Veteran Market Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”