Model Notes: VIX triggers a sell, first entry signal for the feature market for November. The volatility index has been stagnant for 3-weeks. Now non-linear analysis calls for lower values ahead. And gold? The last trade was very profitable. Now the yellow metal models are searching for a new opportunity.

Featured market rotation: VIX for November (looking for a starting signal now). Brazilian real for December. S&P for January. Gold is currently non-rotational.

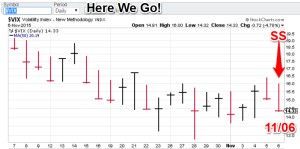

Model Portfolio Signals: (Gold) Flat Signal= 11/03 (TSP=105.97), (VIX) Sell=11/06 (TSP=waiting for the next closing trade)

Note: TSP is calculated by using the closing price of the trading day after the signal day.

Nonlinear Trading Themes:

Gold: The 10/20 – 11/03 signal was a very good trade. The yellow metal continues to push lower despite being technically oversold. The model gold portfolio signal is still flat.

Gold: The 10/20 – 11/03 signal was a very good trade. The yellow metal continues to push lower despite being technically oversold. The model gold portfolio signal is still flat. VIX (Nov. Featured Market): We got an entry signal (sell) based on Friday’s data. The market has been in trading range for three weeks. Indications are for lower prices. This should be a plus for the current S&P rally. The model VIX portfolio is now short..

VIX (Nov. Featured Market): We got an entry signal (sell) based on Friday’s data. The market has been in trading range for three weeks. Indications are for lower prices. This should be a plus for the current S&P rally. The model VIX portfolio is now short..

Note: Technical analysis comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- I am now offering a more a la carte fee system for CTM research. Purchasers can now mix and match signals on various symbols that are currently available. Click on the ‘Fees’ tab for more info.

- With deflationary forces becoming more dominant, top level, successful, investment strategies are going to become more reliant on ‘activity’ (trading). Check out ConquerTheMummy.com for trading signals that help!

- Remember: Nonlinear trading analysis is “insider knowledge” (non-apparent) for standard technical analysis.

- The post-mortem for the US dollar has been posted. To view it select the “Forex” tab on ConquerTheMummy.com.

GH Garrett – Veteran Market Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”