I am returning with my nonlinear signals, following a consulting theme (i.e. dropping the micro hedge fund) pretty much as the heritage of the website. Posting signals for select markets, based on nonlinear models.

This cycle (through Dec 31), I will be tracking the S&P 500, interest rates ($TNX) and the volatility index ($VIX). These three should be of more than casual interest for a wide range of market followers.

Model notes: I post signals when they occur, but since I am re-starting (since my schedule now permits it) between signals, I am giving the general nonlinear ‘in progress signals’. I am awaiting either change-of-trend or reconfirming signals.

Note: The following comments are based on using technical analysis to ‘flesh out’ our nonlinear trading signals.

Nonlinear Trading Themes:

Short Yields ($TNX): This market has been such a disappointment for yield bulls. The heady talk of increased economic activity (Trump election) leading to increased inflation and the Fed aggressively pushing the “hike” button just seems to have sagged for now. The general press seems apoplectic concerning Trump (moving from Russian conspiracies to the protests/brawling surrounding the removal of various Confederate statues). The stymied advance in rates have unsettling ramifications about the future of the US economy.

Short Yields ($TNX): This market has been such a disappointment for yield bulls. The heady talk of increased economic activity (Trump election) leading to increased inflation and the Fed aggressively pushing the “hike” button just seems to have sagged for now. The general press seems apoplectic concerning Trump (moving from Russian conspiracies to the protests/brawling surrounding the removal of various Confederate statues). The stymied advance in rates have unsettling ramifications about the future of the US economy. Short Stocks ($SPX): This category has clearly benefitted from the Trump euphoria, however even big advances must hit an occasional pause. We seem to be in one now. Nonlinear analysis is currently pointing down but near-term support is nearby (2410), so we have to see how this goes.

Short Stocks ($SPX): This category has clearly benefitted from the Trump euphoria, however even big advances must hit an occasional pause. We seem to be in one now. Nonlinear analysis is currently pointing down but near-term support is nearby (2410), so we have to see how this goes. Equity volatility ($VIX): Volatility, the mercurial (and relatively inverse) cousin of bluechips is the 3rd . Anticipating this market is key to making this work as a trading vehicle. Nonlinear analysis should be a powerful tool for this type of trading problem.

Equity volatility ($VIX): Volatility, the mercurial (and relatively inverse) cousin of bluechips is the 3rd . Anticipating this market is key to making this work as a trading vehicle. Nonlinear analysis should be a powerful tool for this type of trading problem.

Premium Research notes:

Observation: We are changing our premium services for 2017. Stay tuned for the details of the new service to be offered. Get your independent research here, put my 25+ years of model building experience to work for you!

Take a minute to peruse the US Equities tab. I posted the S&P 500 trading signals postmortem for the recent March-April time period (approx. as it took about a week to generate a signal at the beginning). Plus 134 Points. Great stuff!

Take a minute to check out the Forex tab on our website. I am posting the recent US Dollar May-June signals. No whipsaws and playing the surprise Brexit vote just right. Great stuff!

Take a minute to take a minute to click on our bond trading tab. Our signals took the profits in the early month while holding the long interest rates position later. It never sold rates, hinting at higher rates to come. The TBT went higher outside our test window. A nice tip-off for the future!

Check out the energy tab. We tracked crude during the run up to the US presidential election. There was plenty negativity with a surprise ending. See how nonlinear analysis walked us through it!

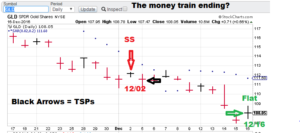

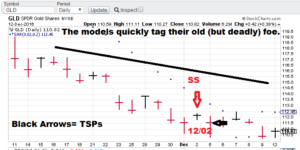

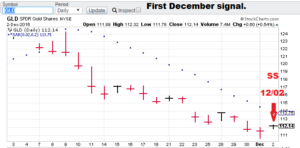

GH Garrett – Chief Market Analyst for ConquertheMummy.com © 2015-2017, “Nonlinear trading signals that matter in gold trading.”