Dec-Jan Rotations: Core Mkt = Gold, Featured Mkt = Asset class Portfolio.

Signals: Gld = Sell 01/06 (TSP= Waiting), AC Portfolio= bought 12/29, Sea-Change status= Reconfirm.

Model notes: Gold model issued a sell, and this looks to reverse a profitable long signal (on a swing-trade type of time frame. The asset class ranking portfolio is rumbling along, positive but a little behind the control portfolio, thanks to this week’s bond rally. We expect bonds to sell off soon.

Note: ALL Mummy calculations use the TSP (Theoretical Signal Price)! The TSP metric is calculated by using the ‘close’ price of the trading day FOLLOWING the signal day (giving you plenty of time to take the signal).

Note: The following comments are based on using technical analysis to ‘flesh out’ our nonlinear trading signals.

Nonlinear Trading Themes:

Gold Trading Signals (Core). The models are now indicating the bull bounce is over. We have a “short” signal after the 12/29 “buy,” and it looks to be a positive trade (we must wait for the TSP to be sure). With an environment of increasing rates and a solid currency, the backdrop for a sustained upward move for gold does not seem likely. So far, so good.

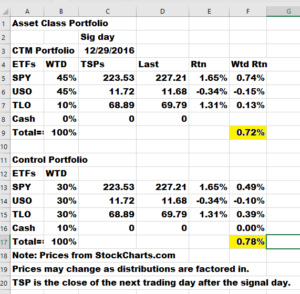

Gold Trading Signals (Core). The models are now indicating the bull bounce is over. We have a “short” signal after the 12/29 “buy,” and it looks to be a positive trade (we must wait for the TSP to be sure). With an environment of increasing rates and a solid currency, the backdrop for a sustained upward move for gold does not seem likely. So far, so good. Asset Class Portfolio (Featured). The rebalance point proved good (near the two-week lows on the SPY) and thus the portfolio is positive. However, the recent rally of the bond market has us underperforming the control portfolio by a modest 6 basis points (for about a week). We do not expect bond rally to go much further. The portfolio asset classes are: SPY (stocks), TLO (bonds) and USO (energy). We are displaying the CTM portfolio as well as a control (balanced) portfolio for comparison.

Asset Class Portfolio (Featured). The rebalance point proved good (near the two-week lows on the SPY) and thus the portfolio is positive. However, the recent rally of the bond market has us underperforming the control portfolio by a modest 6 basis points (for about a week). We do not expect bond rally to go much further. The portfolio asset classes are: SPY (stocks), TLO (bonds) and USO (energy). We are displaying the CTM portfolio as well as a control (balanced) portfolio for comparison.

Premium Research notes:

Observation: Is it just me, or would our premium ranking signals make a great (moderately priced) addition to any hedge fund strategy? Don’t sit around your Monday morning meetings giving each other high-fives with a two-star strategy on the books. Nonlinear portfolio construction can give you an edge. Contact me for more info. Click the ‘Ranking’ tab to find out additional info. By the way, in 2017, I am only going to take on 4 clients!

We are now offering asset class ranking (or alternatively sector ranking), using our trading signal technology on a longer timeframe. This is an exciting new product as portfolio construction has one glaring, missing puzzle piece: what asset classes will continue to outperform/advance for next month? Get your independent research here, put my 25+ years of model building experience to work for you!

Take a minute to peruse the US Equities tab. I posted the S&P 500 trading signals postmortem for the recent March-April time period (approx. as it took about a week to generate a signal at the beginning). Plus 134 Points. Great stuff!

Take a minute to check out the Forex tab on our website. I am posting the recent US Dollar May-June signals. No whipsaws and playing the surprise Brexit vote just right. Great stuff!

Take a minute to take a minute to click on our bond trading tab. Our signals took the profits in the early month while holding the long interest rates position later. It never sold rates, hinting at higher rates to come. The TBT went higher outside our test window. A nice tip-off for the future!

Check out the energy tab. We tracked crude during the run up to the US presidential election. There was plenty negativity with a surprise ending. See how nonlinear analysis walked us through it!

GH Garrett – Chief Market Analyst for ConquertheMummy.com © 2015-2017, “Nonlinear trading signals that matter in gold trading.”