**** Important Post Vacation Note – Since my last pre-vacation note (July 16th) gold took a really big hit. The S&P was not so bad as the levels are near the last exit. I became concerned that the latest model modification (V 2.0) is not active enough to keep us out of protracted adverse moves. I am adding modifications to speed up the signals resulting in V2S (the “S” stands for speedy) nonlinear trading model to help this out. Part of this week’s comments theme regards moving the previous signals into sync with the modified model.

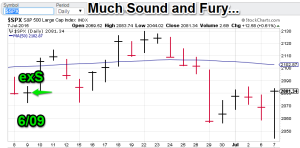

Model Portfolios: Gold = Flat/exit long 7/27 (formerly bullish 6/04), S&P 500= Buys 7/27 (was flat from 6/09), VIX= Sells 7/27 (finally!).

Nonlinear Trading Themes:

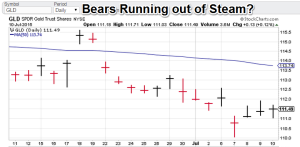

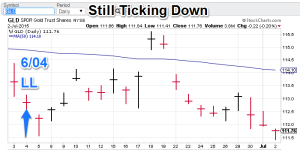

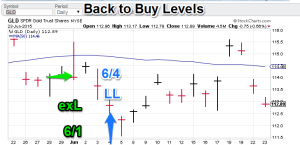

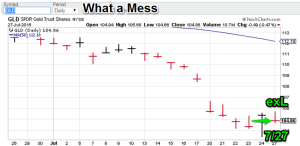

Gold: Just to state the obvious, the recent gold call was terrible. The model V2S is flat. So to transition to the new signal is simple: the gold model portfolio moves to flat. Maybe a new entry signal near the end of the week? Chinese weakness is fanning the fear that a wave of deflation awaits the world in general and commodities in specific.

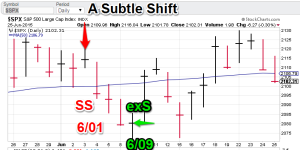

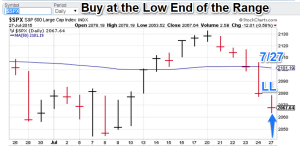

Gold: Just to state the obvious, the recent gold call was terrible. The model V2S is flat. So to transition to the new signal is simple: the gold model portfolio moves to flat. Maybe a new entry signal near the end of the week? Chinese weakness is fanning the fear that a wave of deflation awaits the world in general and commodities in specific. S&P 500: The S&P 500 fell back last week and is now near the low end of the range. The level is lower than the exit short close from the earlier signal. Model V2S indicates little downside and the monthly chart is in agreement. So is the VIX model. The S&P 500 portfolio is now bullish.

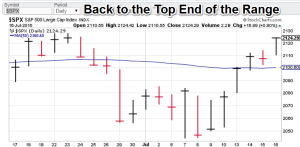

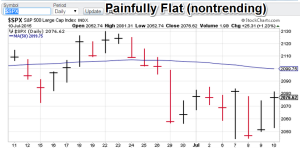

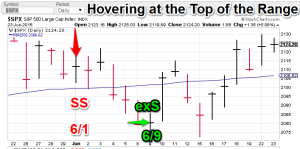

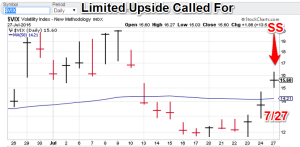

S&P 500: The S&P 500 fell back last week and is now near the low end of the range. The level is lower than the exit short close from the earlier signal. Model V2S indicates little downside and the monthly chart is in agreement. So is the VIX model. The S&P 500 portfolio is now bullish. $VIX (S&P volatility): The V2S model sold today, indicating that the pop-up is likely to not have the juice to push higher. One interesting thing is that the model is squarely in agreement (remember the inverse relationship between the VIX and the $S&P) with the S&P 500 readings. Previously they weren’t quite on the same page.

$VIX (S&P volatility): The V2S model sold today, indicating that the pop-up is likely to not have the juice to push higher. One interesting thing is that the model is squarely in agreement (remember the inverse relationship between the VIX and the $S&P) with the S&P 500 readings. Previously they weren’t quite on the same page.

Note: Technical comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as the Bond trading signals.

GH Garrett – Veteran Commodity Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”