Model Portfolios: Gold = Bullish 6/04, S&P 500= flat 6/09, VIX= waiting for new entry.

Nonlinear Trading Themes:

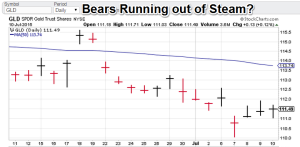

Gold: Gold hit a low, intra day on July 7th (GLD basis) and has proceeded with a rally on the following days. Technically, this indicates the sellers are running out of ammo. The gold model portfolio is long (and out of the money on the current signal), but the downside momentum is moderating.

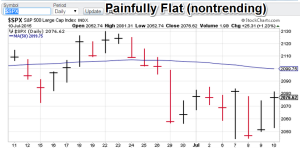

Gold: Gold hit a low, intra day on July 7th (GLD basis) and has proceeded with a rally on the following days. Technically, this indicates the sellers are running out of ammo. The gold model portfolio is long (and out of the money on the current signal), but the downside momentum is moderating. S&P 500: The largecap trend is dead (flat). Earlier, I had tenuous indications (mainly from pre-production Vix) that the next pop would be bullish. Now $VIX is flat also. The closing price on the S&P is about 5 points from our exit short level. The last 4 days have been a series of gyrations leading nowhere. The S&P 500 portfolio is flat.

S&P 500: The largecap trend is dead (flat). Earlier, I had tenuous indications (mainly from pre-production Vix) that the next pop would be bullish. Now $VIX is flat also. The closing price on the S&P is about 5 points from our exit short level. The last 4 days have been a series of gyrations leading nowhere. The S&P 500 portfolio is flat.- $VIX (S&P volatility): As mentioned above the pre-production VIX model is flat (neutral) So, I am waiting for an entry signal. What is the watch phrase? Keep your powder dry.

Note: Technical comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as the Bond trading signals.

GH Garrett – Veteran Commodity Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”