Model Notes: The late breaking news on the shooting in California helped topple equities (previous $VIX buy had us on the right side of this), but may have ramifications on other markets as well. At this writing, a motive was not disclosed, however extremist attack odds have the edge as recent ‘homegrown’ attacks have featured lone gunmen in movie theaters (Louisiana and Colorado) not a team of shooters. We will see as the news filters out.

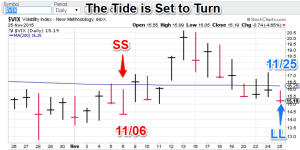

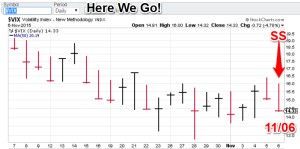

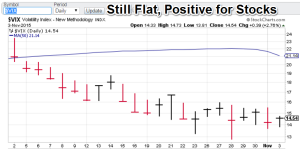

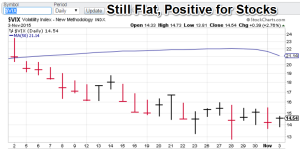

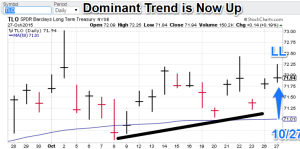

Featured market rotation: VIX for November (goodbye). Brazilian real for December (hello). S&P for January. Gold is currently non-rotational.

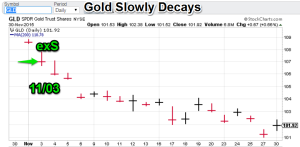

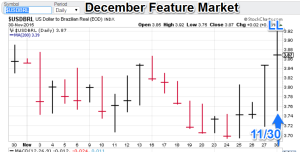

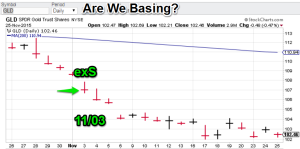

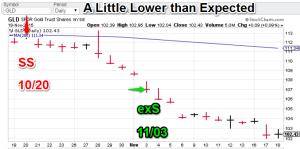

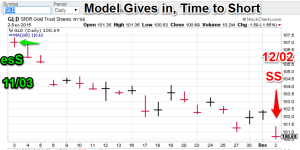

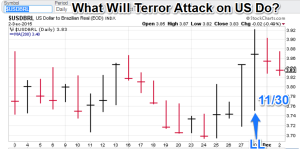

Model Portfolio Signals: (Gold) sell signal = 12/02 (TSP=waiting),. The Brazilian real long signal 11/30 (TSP=3.853).

Note: TSP is calculated by using the closing price of the trading day after the signal day.

Nonlinear Trading Themes:

Gold: The yellow metal dropped today and as the GLD was trading during the initial news of the US shootings, it is interesting to note there was no buying. The models have spent most of the month flat, searching for an entry. The indicators are now signaling a drop ahead. The model gold portfolio is now short.

Gold: The yellow metal dropped today and as the GLD was trading during the initial news of the US shootings, it is interesting to note there was no buying. The models have spent most of the month flat, searching for an entry. The indicators are now signaling a drop ahead. The model gold portfolio is now short. Brazilian Real (Dec. Featured Market): The shallow downticks after the ‘buy’ signal are actually constructive as it gives bullish traders the opportunity to take a position. The Real model remains

Brazilian Real (Dec. Featured Market): The shallow downticks after the ‘buy’ signal are actually constructive as it gives bullish traders the opportunity to take a position. The Real model remains

Note: Technical analysis comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- I am now offering a more a la carte fee system for CTM research. Purchasers can now mix and match signals on various symbols that are currently available. Click on the ‘Fees’ tab for more info.

- With deflationary forces becoming more dominant, top level, successful, investment strategies are going to become more reliant on ‘activity’ (trading). Check out ConquerTheMummy.com for trading signals that help!

- Remember: Nonlinear trading analysis is “insider knowledge” (non-apparent) for standard technical analysis.

- The post-mortem for the US dollar has been posted. To view it select the “Forex” tab on ConquerTheMummy.com.

GH Garrett – Veteran Market Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”