Model Gold Portfolios: Gold = Bullish 6/04, S&P 500 – flat 6/09, VIX designing model.

Technical Read:

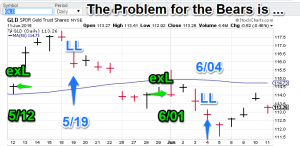

Gold: Gold broke down in early June, signaling some to expect lower prices (a now-trending-down interpretation) however the gold bears still have a problem. Nonlinear trading analysis has gold pegged as crazy oversold. This theme effectively means all the risk is on the bearish side of the table (or in other words the next “surprise” will be one that pops prices up). I expect sellers to be skittish. The model Gold portfolio is still bullish

Gold: Gold broke down in early June, signaling some to expect lower prices (a now-trending-down interpretation) however the gold bears still have a problem. Nonlinear trading analysis has gold pegged as crazy oversold. This theme effectively means all the risk is on the bearish side of the table (or in other words the next “surprise” will be one that pops prices up). I expect sellers to be skittish. The model Gold portfolio is still bullish S&P 500: Largecaps popped after we issued the signal to clear out the shorts, so we seem to be still in synch with the current trading. The next step? We need to see more trading to help clarify where we are on this asset class The S&P 500 model is still flat.

S&P 500: Largecaps popped after we issued the signal to clear out the shorts, so we seem to be still in synch with the current trading. The next step? We need to see more trading to help clarify where we are on this asset class The S&P 500 model is still flat.- $VIX (S&P volatility): We did well with this last pre-production signal as well (and we are now flat). Low end of recent trading is 12.00. We are getting close. But traders need to take care, as this index has piled up a lot of bodies over the years.

Note: Technical comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as

GH Garrett – Veteran Commodity Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”