Model Gold Portfolios: Gold = Bullish 6/04, S&P 500= flat 6/09, VIX= designing model.

Technical Read:

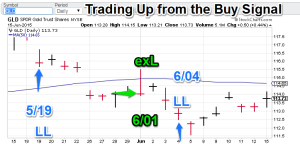

Gold: Gold lifted today as the nonlinear trading signal analysis inspired dearth-of-sellers theme met a modestly unsettling market backdrop of a Greece exit and possible Fed positional changes (both issues are heavy on talk, light on action). We are still higher than our entry signal. The model Gold portfolio is still bullish

Gold: Gold lifted today as the nonlinear trading signal analysis inspired dearth-of-sellers theme met a modestly unsettling market backdrop of a Greece exit and possible Fed positional changes (both issues are heavy on talk, light on action). We are still higher than our entry signal. The model Gold portfolio is still bullish S&P 500: Largecaps are pretty close to our exit levels. The recent advantage of the signals is that we avoided getting hit with a sizable whipsaw. I don’t have to tell grizzled traders how good that feels. So now what? We look for the next tradable move. But for now, the S&P 500 model is still flat.

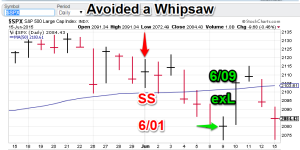

S&P 500: Largecaps are pretty close to our exit levels. The recent advantage of the signals is that we avoided getting hit with a sizable whipsaw. I don’t have to tell grizzled traders how good that feels. So now what? We look for the next tradable move. But for now, the S&P 500 model is still flat.- $VIX (S&P volatility): The pre-production VIX trading signals are close (but inverse) to the S&P signals. But now both are flat. Missing the rapid 2-day rally was tougher. But you can’t catch every trade.

Note: Technical comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as

GH Garrett – Veteran Commodity Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”