System Notes: We get the first gold entry (short) signal with the new model (V2.0S)! Featured market rotation: Equities for August, US Dollar for September and Bonds for October. Gold is our staple.

Model Portfolios: Gold = Sell 8/11, S&P 500= Buy 7/27, VIX= Sell 7/27

Nonlinear Trading Themes:

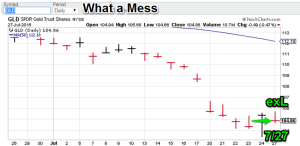

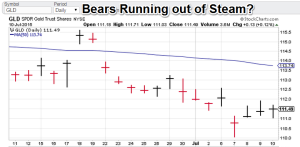

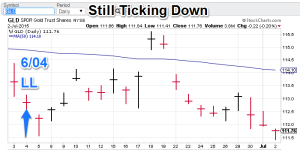

Gold: Gold rallied after the China currency devaluation, but not as convincingly as some hoped. The model is advising this is an opportunity to sell the yellow metal. Downside projections are not extreme with a retest of 104.25 likely. The model gold portfolio is short.

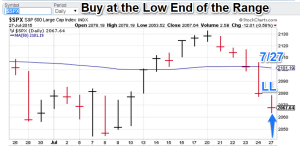

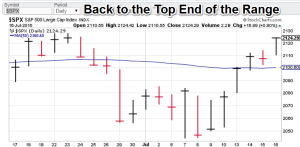

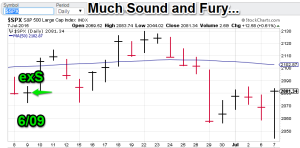

Gold: Gold rallied after the China currency devaluation, but not as convincingly as some hoped. The model is advising this is an opportunity to sell the yellow metal. Downside projections are not extreme with a retest of 104.25 likely. The model gold portfolio is short. S&P 500 (August Featured Market): Largecaps reversed abruptly from the previous day’s gains in the wake of the currency hiccup. But, tellingly they failed to push through the lows of 7/27 and 8/07 (2065, S&P 500 basis). Equities are adjusting to the post-currency levels and we expect higher prices going forward from today’s lows. The S&P 500 portfolio is still bullish.

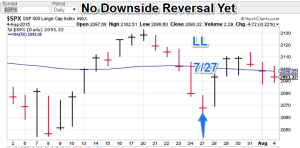

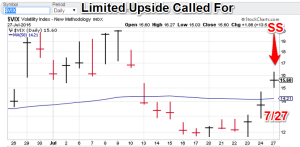

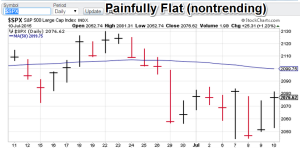

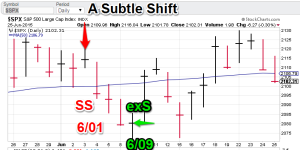

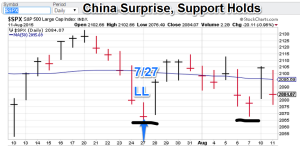

S&P 500 (August Featured Market): Largecaps reversed abruptly from the previous day’s gains in the wake of the currency hiccup. But, tellingly they failed to push through the lows of 7/27 and 8/07 (2065, S&P 500 basis). Equities are adjusting to the post-currency levels and we expect higher prices going forward from today’s lows. The S&P 500 portfolio is still bullish. $VIX (S&P volatility) (August Featured Market): …And if stocks go up? That’s right, the VIX should get a good close look at the 11 level. VIX portfolio is still bearish.

$VIX (S&P volatility) (August Featured Market): …And if stocks go up? That’s right, the VIX should get a good close look at the 11 level. VIX portfolio is still bearish.

Note: Technical analysis comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as the Bond trading signals. Currently available.

- We now offer S&P 500 signals (along with the choppy $VIX). This index is a mainstay among financial participants and traders around the world. Sign-up for exclusive signals to give you the edge. Currently available.

GH Garrett – Veteran Commodity Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”