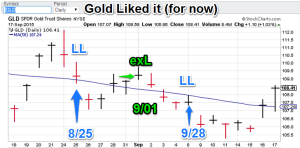

Model Notes: The bond model changed signal position to “up” today. This comes after being short for the entire month of October. From a model perspective the, this market has been in a tight trading range and thus tough to call a direction. On the plus side, the model avoided the pitfall of a series of whipsaws that plagues many linear trend following models in these situation. So no: chop, chop, chop. The gold model is still short and waiting for more substantial selloff to develop.

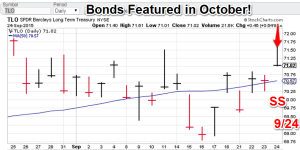

Featured market rotation: Bonds for October (waiving goodbye soon) VIX for November (looking for a starting signal now). Brazilian real for December. Gold is currently non-rotational.

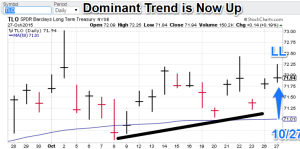

Model Portfolio Signals: (Gold) Short= 10/20 (TSP=42.76), (Bonds/TLO) Buy =10/27 (TSP= waiting)

Note: TSP is calculated by using the closing price of the trading day after the signal day.

Nonlinear Trading Themes:

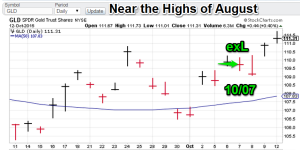

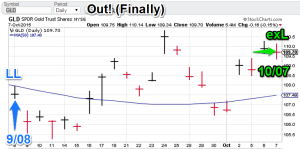

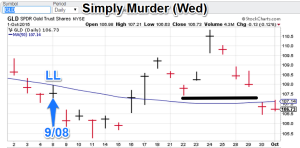

Gold: The yellow metal has been selling off after the 10/20 sell signal but without much gusto. Support is currently at 111 (GLD basis). The current pause on the downside does not look like a classic technical bottom. The model is indicating lower prices. The model gold portfolio is still short.

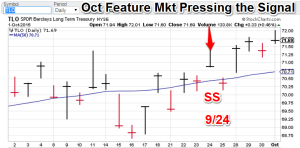

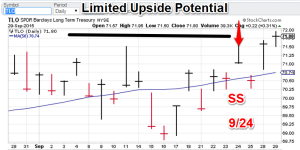

Gold: The yellow metal has been selling off after the 10/20 sell signal but without much gusto. Support is currently at 111 (GLD basis). The current pause on the downside does not look like a classic technical bottom. The model is indicating lower prices. The model gold portfolio is still short. Bonds (Oct. Featured Market): The TLO model flipped to “buy” today. The model has been a staunch supporter of a Fed move before the end of the year. But now this has changed. If you look at the dominant monthly trend (bottoms on 10/8, 10/20 and 10/23), it is now pointing upward. So the Fed holds its fire a little longer. What will the country do? The model bond portfolio is now bullish.

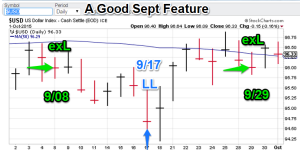

Bonds (Oct. Featured Market): The TLO model flipped to “buy” today. The model has been a staunch supporter of a Fed move before the end of the year. But now this has changed. If you look at the dominant monthly trend (bottoms on 10/8, 10/20 and 10/23), it is now pointing upward. So the Fed holds its fire a little longer. What will the country do? The model bond portfolio is now bullish.- VIX (Nov. Featured Market) Trading Signals (no chart shown yet): I starting looking for an entry signal recently and simply got non-trending readings. This has been positive for stocks. So far, no buy signal. Stocks should continue up for now. I am still searching for an entry signal.

Note: Technical analysis comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- I am now offering a more a la carte fee system for CTM research. Purchasers can now mix and match signals on various symbols that are currently available. Click on the ‘Fees’ tab for more info.

- With deflationary forces becoming more dominant, top level, successful, investment strategies are going to become more reliant on ‘activity’ (trading). Check out ConquerTheMummy.com for trading signals that help!

- Remember: Nonlinear trading analysis is “insider knowledge” (non-apparent) for standard technical analysis .

- The post-mortem for the US dollar has been posted. To view it select the “Forex” tab on ConquerTheMummy.com.

GH Garrett – Veteran Market Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”