System Notes: The current model (V2.0S) is still preforming well with all signals ‘in the money.’ The S&P may pose some challenges going into the new week. Featured markets are Equities for August, US Dollar for September and Bonds for October. Gold is our staple.

Model Portfolios: Gold = Flat 7/27, S&P 500= Buy 7/27, VIX= Sell 7/27

Nonlinear Trading Themes:

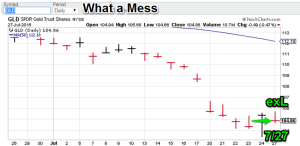

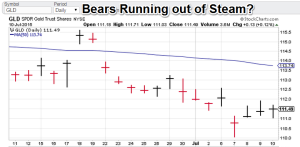

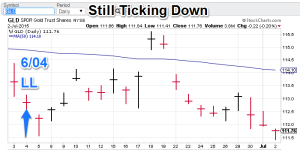

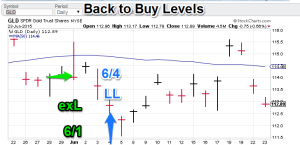

Gold: The yellow metal is still flat. The question is whether the market is basing (prelude to a bounce) or in a continuation formation (a pause before pushing lower). The models offer the clue that gold is oversold. So the best course is to wait for more definitive instructions. The model gold portfolio is flat.

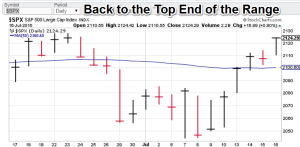

Gold: The yellow metal is still flat. The question is whether the market is basing (prelude to a bounce) or in a continuation formation (a pause before pushing lower). The models offer the clue that gold is oversold. So the best course is to wait for more definitive instructions. The model gold portfolio is flat. S&P 500 (August Featured Market): Largecaps pushed lower on Friday but rallied well off the lows by the end of day. The S&P is still one of the stronger non-sector equity indexes. The DJAI is weaker but after 7 straight down days one could expect a pop in the new week. The S&P 500 found support at the 2060 level. Bullish readings should translate into some strength going into the new week. A lot of analysts (at least of TV) seem to have an air of pessimism (that’s bullish, right?). The S&P 500 portfolio is still bullish.

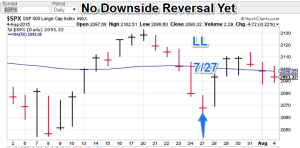

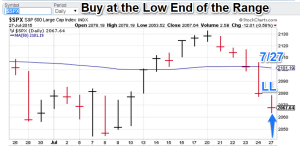

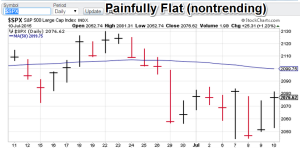

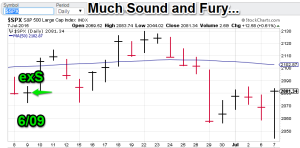

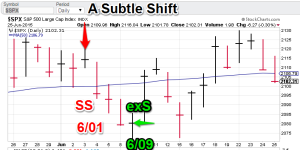

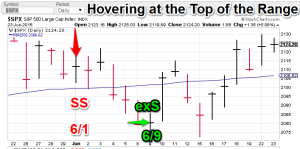

S&P 500 (August Featured Market): Largecaps pushed lower on Friday but rallied well off the lows by the end of day. The S&P is still one of the stronger non-sector equity indexes. The DJAI is weaker but after 7 straight down days one could expect a pop in the new week. The S&P 500 found support at the 2060 level. Bullish readings should translate into some strength going into the new week. A lot of analysts (at least of TV) seem to have an air of pessimism (that’s bullish, right?). The S&P 500 portfolio is still bullish. $VIX (S&P volatility) (August Featured Market): The VIX punched through near-term support (12) before rallying back on equity weakness. I found it interesting the VIX closed down on Friday despite the S&P closed down as well. This index is not signaling a breakdown in stocks yet. VIX portfolio is still bearish.

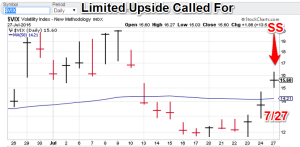

$VIX (S&P volatility) (August Featured Market): The VIX punched through near-term support (12) before rallying back on equity weakness. I found it interesting the VIX closed down on Friday despite the S&P closed down as well. This index is not signaling a breakdown in stocks yet. VIX portfolio is still bearish.

Note: Technical analysis comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as the Bond trading signals. Currently available.

- We now offer S&P 500 signals (along with the choppy $VIX). This index is a mainstay among financial participants and traders around the world. Sign-up for exclusive signals to give you the edge. Currently available.

GH Garrett – Veteran Commodity Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”