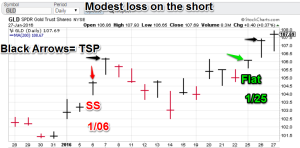

Model Notes: The gold model kicked us out of the losing trade. Friday’s action had positive aspects (settling well off the session lows) but against a backdrop of sellers pressing the support level and down-trending technicals, getting out is probably the right thing to do. Let’s see what kind of TSP we get. Stock readings are still bullish. It’s 2100 or bust. I am introducing an exciting new product to the institutional market: Asset class ranking! Check the tab. We will be using the trading technology on a longer timeframe to help portfolio managers out-perform. This is economical and smart.

March Rotations: Core Gold, Featured: S&P 500 (I am now keeping the same markets for April).

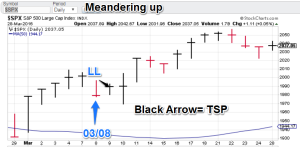

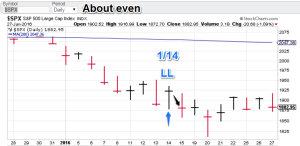

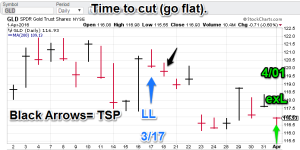

Model Portfolio Signals: GLD flat on 4/1 (TSP=waiting), S&P 500 buy on 3/08 (TSP= 1989.26)

Note: TSP is calculated by using the closing price of the trading day after the signal day. It is more realistic for trading calculations/evaluations.

Nonlinear Trading Themes:

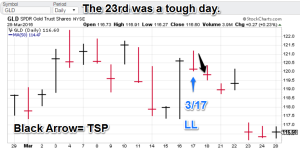

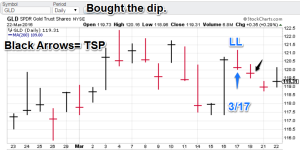

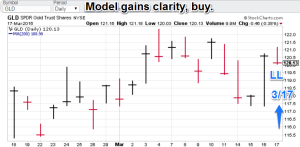

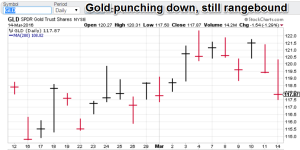

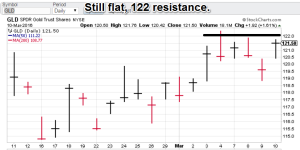

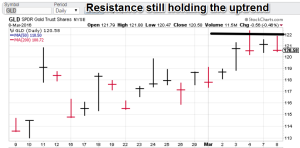

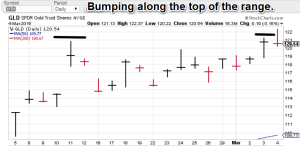

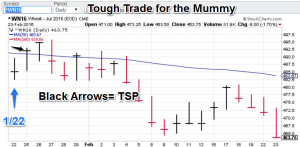

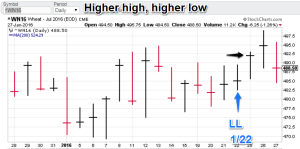

Gold (Mar. and Apr. core market) Sellers are pressing the 117 support level (GLD basis) and short term action is displaying down trending characteristics (lower lows and lower highs). The models want none of it. The gold model is signaling flat. We have to see what we get out at with Monday’s close (the TSP value).

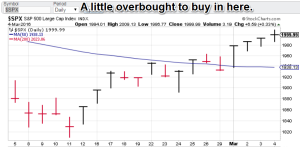

Gold (Mar. and Apr. core market) Sellers are pressing the 117 support level (GLD basis) and short term action is displaying down trending characteristics (lower lows and lower highs). The models want none of it. The gold model is signaling flat. We have to see what we get out at with Monday’s close (the TSP value). S&P 500 (Mar. and Apr. feature): The S&P 500 closed at the highest close of the week. The siren song to 2100 seems the favorite bet. The models agree. The stock model stays bullish.

S&P 500 (Mar. and Apr. feature): The S&P 500 closed at the highest close of the week. The siren song to 2100 seems the favorite bet. The models agree. The stock model stays bullish.

Premium offers:

- I am now offering a ranking product for institutional clients engaged in asset allocation. I will be using the trading signal technology with a longer time frame to aid in portfolio construction for money managers. I have introductory rates (as low as $5,000 a quarter). Click the ‘ranking’ tab to see more. I have a limited number of slots to fill.

- I am now offering reasonable rates to institutional clients to get access to our mathematically inspired signals. Click on the ‘Fees’ tab for more info. I have a limited number of slots to fill.

- Remember: Non-linear trading analysis is non-apparent and therefore like “insider knowledge” for standard technical analysis. Be the first to get a “head-up” for coming moves.

- The post-mortems for the recent US dollar and the VIX featured markets have been posted. To view it select the “Forex” or “US Equity” tabs (respectively) on ConquerTheMummy.com.

GH Garrett – Veteran Market Watcher for ConquertheMummy.com © 2015-2016, “Nonlinear signals that matter in gold (and wheat) trading.”