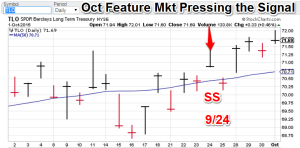

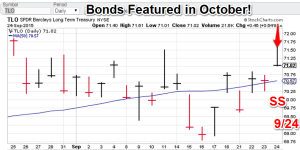

Model Notes: The gold model is changing its position from flat to short. Prices are pretty lofty and the odds seem to favor a pullback of some sort. The bond model (as shown on the TLO) is anticipating lower prices. The upcoming feature market for November is the $VIX. Going forward, I am looking for a pre-November entry to get set up for the action. Currently, we have volatility as flat (which probably is positive for the stock market).

Featured market rotation: Bonds for October. VIX for November. Brazilian real for December. Gold is currently non-rotational.

Model Portfolio Signals: (Gold) Short= 10/20 (TSP=Wait), (Bonds/TLO) Sell =9/24 (TSP= 70.36)

Note: TSP is calculated by using the closing price of the trading day after the signal day.

Nonlinear Trading Themes:

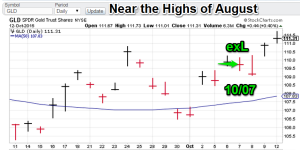

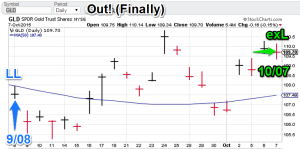

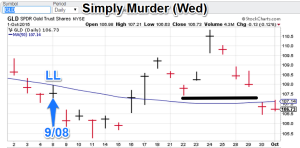

Gold: The yellow metal took the moonshot and is now pausing. The models issued an outright ‘sell short’ signal tonight. The recent jump has put this market in overbought territory so the change of position feels good. There are several upcoming issues that the gold bulls will have to contend with. US largecaps are pushing higher, an inter-market relationship that is not going to bring gold buyers to the table. The other issue is the looming Fed hike. The models are forecasting higher rates, another strike against the gold bulls. The model gold portfolio is now short.

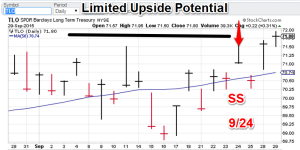

Gold: The yellow metal took the moonshot and is now pausing. The models issued an outright ‘sell short’ signal tonight. The recent jump has put this market in overbought territory so the change of position feels good. There are several upcoming issues that the gold bulls will have to contend with. US largecaps are pushing higher, an inter-market relationship that is not going to bring gold buyers to the table. The other issue is the looming Fed hike. The models are forecasting higher rates, another strike against the gold bulls. The model gold portfolio is now short. Bonds (Oct. Featured Market): The TLO is starting to feel heavy here with a trading high on Oct 2 and a lower high on Oct 14. A close below the 50-day average may be enough to start the bond bears rolling. The model bond portfolio remains bearish.

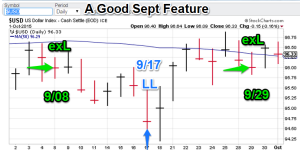

Bonds (Oct. Featured Market): The TLO is starting to feel heavy here with a trading high on Oct 2 and a lower high on Oct 14. A close below the 50-day average may be enough to start the bond bears rolling. The model bond portfolio remains bearish.- VIX (Nov. Featured Market) Trading Signals (no chart shown yet): I am looking for a signal to get this set up for trading analysis in November. The most recent signal is a resounding ‘flat’. So I am still searching for a future move to exploit.

Note: Technical analysis comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- I am now offering a more a la carte fee system for CTM research. Purchasers can now mix and match signals on various symbols. Currently available. Click on the ‘Fees’ tab for more info.

- With deflationary forces becoming more dominant, top level, successful, investment strategies are going to become more reliant on ‘activity’ (trading). Check out ConquerTheMummy.com for trading signals that help!

- Remember: Nonlinear trading analysis is “insider knowledge” (non-apparent) for standard technical analysis .

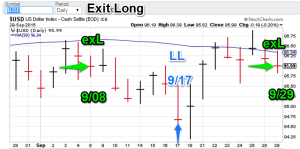

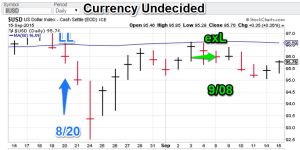

- The post-mortem for the US dollar has been posted. To view it select the “Forex” tab on ConquerTheMummy.com.

GH Garrett – Veteran Market Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”