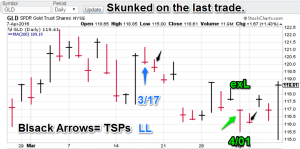

Model Notes: The stock model seems to be still in sync with the underlying market. We are well north of the entry TSP, and while we had a volatile week, we have not seen anything like a classic reversal. We had less luck on the last gold call. Our entry was followed by selling. Today’s moon-shot like rally (after our exit) was the cherry on the stink pot. Oh well, nobody said it would be easy.

March Rotations: Core Gold, Featured: S&P 500 (I am now keeping the March markets for April).

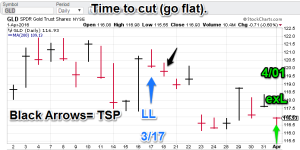

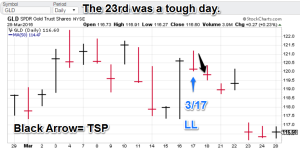

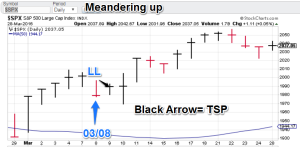

Model Portfolio Signals: GLD flat on 4/1 (TSP=116.15), S&P 500 buy on 3/08 (TSP= 1989.26)

Note: TSP is calculated by using the closing price of the trading day after the signal day. It is more realistic for trading calculations/evaluations.

Nonlinear Trading Themes:

Gold (Mar. and Apr. core market) This market had a moon-shot today, closing not terribly far from our original entry. Sheesh! Recent trading is not revealing much of a trend and the models agree. Flat is the rule of the day.

Gold (Mar. and Apr. core market) This market had a moon-shot today, closing not terribly far from our original entry. Sheesh! Recent trading is not revealing much of a trend and the models agree. Flat is the rule of the day. S&P 500 (Mar. and Apr. feature): The S&P 500 has received some selling this week, but it looks like more of a pause and less like a reversal. Last post I said 2100 or bust. I hope it is 2100. The stock model stays bullish.

S&P 500 (Mar. and Apr. feature): The S&P 500 has received some selling this week, but it looks like more of a pause and less like a reversal. Last post I said 2100 or bust. I hope it is 2100. The stock model stays bullish.

Premium offers:

- I am now offering a ranking product for institutional clients engaged in asset allocation. I will be using the trading signal technology with a longer time frame to aid in portfolio construction for money managers. I have introductory rates (as low as $5,000 a quarter). Click the ‘ranking’ tab to see more. I have a limited number of slots to fill. I can fill the need for independent research.

- Remember: Non-linear trading analysis is non-apparent and therefore like “insider knowledge” for standard technical analysis. Be the first to get a “head-up” for coming moves.

- The post-mortems for the recent US dollar and the VIX featured markets have been posted. To view it select the “Forex” or “US Equity” tabs (respectively) on ConquerTheMummy.com.

GH Garrett – Veteran Market Watcher for ConquertheMummy.com © 2015-2016, “Nonlinear signals that matter in gold (and wheat) trading.” Get your independent research here!