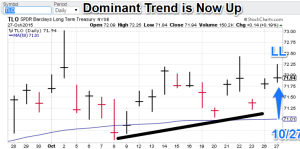

Model Notes: The markets struggle to deal with the effects of the terror attack on France. So how did the models fare? The gold model had us on the sidelines and this is a pretty good read for a turbulent, news-oriented period of trading. The VIX model was caught off-guard (i.e. short) but after three trading days, Wednesday’s closing price is very close to the sell signal TSP. Barring more surprises, the future looks hopeful.

Featured market rotation: VIX for November (looking for a starting signal now). Brazilian real for December. S&P for January. Gold is currently non-rotational.

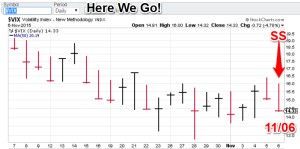

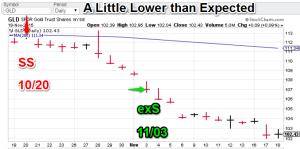

Model Portfolio Signals: (Gold) Flat Signal= 11/03 (TSP=105.97), (VIX) Sell=11/06 (TSP=16.52)

Note: TSP is calculated by using the closing price of the trading day after the signal day.

Nonlinear Trading Themes:

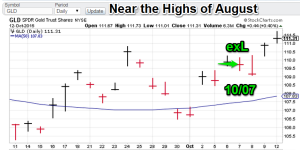

Gold: GLD managed to push below the 104 support area but the technicals are oversold and thus not particularly bearish for the near-term future. If the market has dropped 15 trading days, don’t the next 15 to be the same. The model gold portfolio signal is still flat.

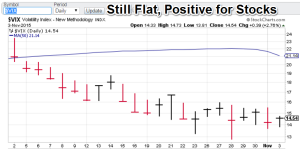

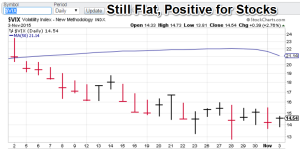

Gold: GLD managed to push below the 104 support area but the technicals are oversold and thus not particularly bearish for the near-term future. If the market has dropped 15 trading days, don’t the next 15 to be the same. The model gold portfolio signal is still flat. VIX (Nov. Featured Market): The surprise Islamic extremist attack on France has introduced more risk in the market, thus moving the VIX up. So now what? The models indicate that the Nov 13 trading high is probably the zenith of the near-term trading range. The model VIX portfolio remains short.

VIX (Nov. Featured Market): The surprise Islamic extremist attack on France has introduced more risk in the market, thus moving the VIX up. So now what? The models indicate that the Nov 13 trading high is probably the zenith of the near-term trading range. The model VIX portfolio remains short.

Note: Technical analysis comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- I am now offering a more a la carte fee system for CTM research. Purchasers can now mix and match signals on various symbols that are currently available. Click on the ‘Fees’ tab for more info.

- With deflationary forces becoming more dominant, top level, successful, investment strategies are going to become more reliant on ‘activity’ (trading). Check out ConquerTheMummy.com for trading signals that help!

- Remember: Nonlinear trading analysis is “insider knowledge” (non-apparent) for standard technical analysis.

- The post-mortem for the US dollar has been posted. To view it select the “Forex” tab on ConquerTheMummy.com.

GH Garrett – Veteran Market Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”