A Brutal First Week Of The Year (SPX)

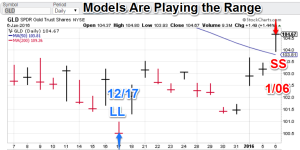

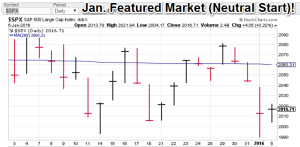

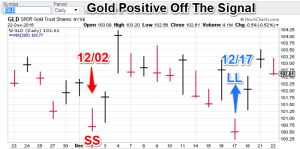

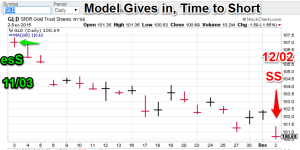

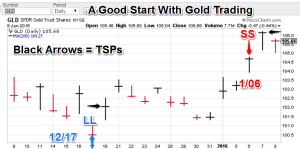

Model Notes: The gold models sold well capturing the highest theoretical signal price (TSP) value of the last 30 days. The entry TSP was definitely at the low end of the recent range. So the models for the yellow metal are on track. The S&P models were just brought online (this is the featured market for January) and are trying to gauge a brutal sell-off for the first days of the new month. Kudos for not going bullish too early.

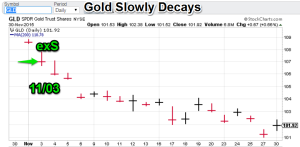

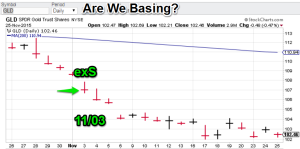

Additional: In the past, I featured gold (in the form of the GLD fund) as a non-rotational signal chart on Conquerthemummy.com postings. I am changing the status from non-rotational to “core.” The effect is that I will be posting signal charts for gold on odd numbered months, and wheat for even months.

Featured market rotation: S&P for January! Core market is gold.

Model Portfolio Signals: (Gold, GLD basis) Sell signal = 1/06 (TSP=106.15).The $S&P is Neutral.

Note: TSP is calculated by using the closing price of the trading day after the signal day. It is more realistic for trading calculations/evaluations.

Nonlinear Trading Themes:

Gold (current core market): Gold has benefitted from a series of geo-global events that popped the yellow metal high and far. The China economic slowdown, intensification of hostilities of rival Islamic factions and the North Korean nuclear tests were all factors. However the models turned bearish on Wednesday possibly indicating the fatigued bulls will be asking themselves “what else could go wrong?” Technically, the models are playing the range, selling the latest breakout. The model gold portfolio is short, positioned for fading strength.

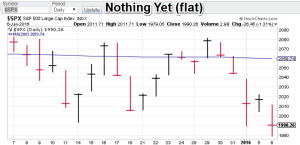

Gold (current core market): Gold has benefitted from a series of geo-global events that popped the yellow metal high and far. The China economic slowdown, intensification of hostilities of rival Islamic factions and the North Korean nuclear tests were all factors. However the models turned bearish on Wednesday possibly indicating the fatigued bulls will be asking themselves “what else could go wrong?” Technically, the models are playing the range, selling the latest breakout. The model gold portfolio is short, positioned for fading strength. S&P 500 (Jan. featured market): I am showing a rare weekly chart on my posts. The models are flat but a couple of things are coming together. Technically the S&P is approaching the lows of August and September (1875), so support is near. Also there is some evidence of a bullish seasonality in January based in part on tax related buying following the distributions of December. An interesting bounce could be in the making and we are waiting to see if our models confirm this. The S&P model is flat.

S&P 500 (Jan. featured market): I am showing a rare weekly chart on my posts. The models are flat but a couple of things are coming together. Technically the S&P is approaching the lows of August and September (1875), so support is near. Also there is some evidence of a bullish seasonality in January based in part on tax related buying following the distributions of December. An interesting bounce could be in the making and we are waiting to see if our models confirm this. The S&P model is flat.

Note: Non linear trading theme comments are based on interpretations of non-linear trading models, combined with chart price action (technical analysis).

Premium offers:

- I am now offering a more a la carte fee system for CTM research. Purchasers can now mix and match signals on various symbols that are currently available. Click on the ‘Fees’ tab for more info.

- With deflationary forces becoming more dominant, top level, successful, investment strategies are going to become more reliant on ‘activity’ (trading). Check out ConquerTheMummy.com for trading signals that help!

- Remember: Nonlinear trading analysis is “insider knowledge” (non-apparent) for standard technical analysis.

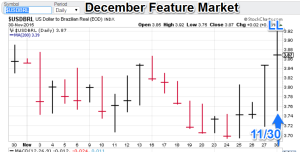

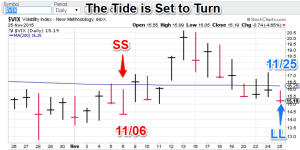

- The post-mortems for the recent US dollar and the VIX featured markets have been posted. To view it select the “Forex” or “US Equity” tabs (respectively) on ConquerTheMummy.com.

GH Garrett – Veteran Market Watcher for ConquertheMummy.com © 2015-2016, “Nonlinear signals that matter in gold trading.”