Model Notes: The stock model identified and uptrend and took advantage of the upcoming pulse. This proved to be good. The gold mode also registered a buy ( little later). However the yellow metal did not do as well in the post-Brussel’s terror attack environment. The Wednesday downdraft put us out of the money on the trade but there was limited follow-through on the selling afterwards. This is a very interesting situation. To pursue it further, I am going to keep the markets the same for April.

March Rotations: Core Gold, Featured: S&P 500 (I am now keeping the same markets for April).

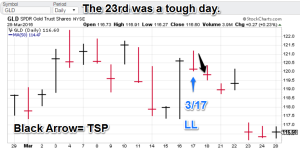

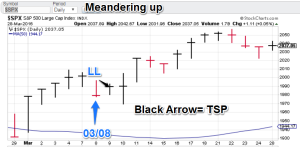

Model Portfolio Signals: GLD buy 3/17 (TSP=119.80), S&P 500 buy on 3/08 (TSP= 1989.26)

Note: TSP is calculated by using the closing price of the trading day after the signal day. It is more realistic for trading calculations/evaluations.

Nonlinear Trading Themes:

Gold (Mar. core market) The market dumped Wednesday of last week, but follow-through selling did not appear. This is a situation seen in trading leading to the question “now what?” I am looking to the models for additional guidance.

Gold (Mar. core market) The market dumped Wednesday of last week, but follow-through selling did not appear. This is a situation seen in trading leading to the question “now what?” I am looking to the models for additional guidance. S&P 500 (Mar. feature): The S&P 500 has had a nice bounce from the lows of the last two months (1800). Now we are closing in on recent highs (2100). Can we break through and go higher. Right now, that looks to be in the cards. Note: Non linear trading theme comments are based on interpretations of non-linear trading models, combined with chart price action (technical analysis).

S&P 500 (Mar. feature): The S&P 500 has had a nice bounce from the lows of the last two months (1800). Now we are closing in on recent highs (2100). Can we break through and go higher. Right now, that looks to be in the cards. Note: Non linear trading theme comments are based on interpretations of non-linear trading models, combined with chart price action (technical analysis).

Premium offers:

- I am now offering reasonable rates to institutional clients. Click on the ‘Fees’ tab for more info. I have a limited number of slots to fill.

- With deflationary forces becoming more dominant, top level, successful, investment strategies are going to become more reliant on ‘activity’ (trading). Check out ConquerTheMummy.com for trading signals that help!

- Remember: Nonlinear trading analysis is “insider knowledge” (non-apparent) for standard technical analysis.

- The post-mortems for the recent US dollar and the VIX featured markets have been posted. To view it select the “Forex” or “US Equity” tabs (respectively) on ConquerTheMummy.com.

- I am accepting introductory offers for a slower moving asset allocation/sector rotation product using the ConquerTheMummy technology. Contact me for the details.

GH Garrett – Veteran Market Watcher for ConquertheMummy.com © 2015-2016, “Nonlinear signals that matter in gold (and wheat) trading.”