Model Notes: I want to introduce a technical term on the ConquertheMummy website: TSP (theoretical signal price). It is calculated by simply using the closing price of the trading day after the signal day. Let’s look at the recent gold signal. The market closed on Sept 8th (I use US closing prices for calculation purposes), then I run the models that evening. A buy signal was generated and that information was posted using the comments and a graph. The signal day is 9/08 but the TSP ends up being the closing price of Sept 9th (106.13 GLD basis). Why bring this up? Two reasons, it is one of the nuances that concerns model makers, and I may bring it up in discussion from time to time.

Featured market rotation: Equities for August, US Dollar for September and Bonds for October. Japanese yen for November. Brazilian real for December. Gold is currently non-rotational.

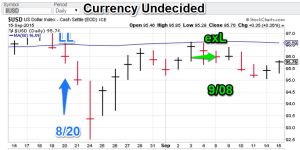

Model Portfolio Signals: (Gold) Buy = 9/08, (USD) Exit Long = 9/08

Nonlinear Trading Themes:

Gold: GLD broke through the 107 support level but pretty much ran out of steam then. So put another way, today’s close was very near the current TSP (see, I put it in!). The yellow metal is waiting for a clearer read on the interest rate picture (I.E. the Fed action). The current read is no action this month but I must admit that rates went up firmly today, so bond traders have some nervousness to the contrary. The model gold portfolio remains long.

Gold: GLD broke through the 107 support level but pretty much ran out of steam then. So put another way, today’s close was very near the current TSP (see, I put it in!). The yellow metal is waiting for a clearer read on the interest rate picture (I.E. the Fed action). The current read is no action this month but I must admit that rates went up firmly today, so bond traders have some nervousness to the contrary. The model gold portfolio remains long. US Dollar (Sept Featured Market): The dollar is languishing ahead of the Fed announcement. With global criticism of a US rate hike and Chinese volatility it is doubtful that action will come this month. Technically, the greenback is range-bound. US Dollar portfolio remains flat.

US Dollar (Sept Featured Market): The dollar is languishing ahead of the Fed announcement. With global criticism of a US rate hike and Chinese volatility it is doubtful that action will come this month. Technically, the greenback is range-bound. US Dollar portfolio remains flat.

Note: Technical analysis comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Forex Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as the Bond trading signals. Currently available.

- We now offer S&P 500 signals (along with the choppy $VIX). This index is a mainstay among financial participants and traders around the world. Sign-up for exclusive signals to give you the edge. Currently available.

GH Garrett – Veteran Commodity Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”