System Notes: The spike after the gold model sell was jarring but did allow traders who planned on taking the bearish signal a chance to get short. Equity signals continue to be on the right side of their respective markets. Featured market rotation: Equities for August, US Dollar for September and Bonds for October. Gold is our staple. I will have further comments on the feature rotation next week.

Model Portfolios: Gold = Sell 8/11, S&P 500= Buy 7/27, VIX= Sell 7/27

Nonlinear Trading Themes:

Gold: Gold popped after the signal but had a significant downside reversal today. The yellow metal is overbought. In the absence of some type of destructive geo-political event, more selling is expected. The model gold portfolio is short.

Gold: Gold popped after the signal but had a significant downside reversal today. The yellow metal is overbought. In the absence of some type of destructive geo-political event, more selling is expected. The model gold portfolio is short. S&P 500 (August Featured Market): Largecaps managed to push below the near-term support (2065 S&P 500 basis) during intraday trading on 8/12, but rallied up to close positive by the end of day. Today’s trading was directionless. However you cut it, the support level is holding. The S&P 500 portfolio is still bullish.

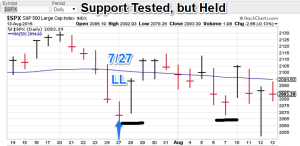

S&P 500 (August Featured Market): Largecaps managed to push below the near-term support (2065 S&P 500 basis) during intraday trading on 8/12, but rallied up to close positive by the end of day. Today’s trading was directionless. However you cut it, the support level is holding. The S&P 500 portfolio is still bullish. $VIX (S&P volatility) (August Featured Market): Vix ticked lower (despite a mildly negative day for stocks), indicating the volatility index is not sensing a significant sell-off in the wind. VIX portfolio is still bearish.

$VIX (S&P volatility) (August Featured Market): Vix ticked lower (despite a mildly negative day for stocks), indicating the volatility index is not sensing a significant sell-off in the wind. VIX portfolio is still bearish.

Note: Technical analysis comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as the Bond trading signals. Currently available.

- We now offer S&P 500 signals (along with the choppy $VIX). This index is a mainstay among financial participants and traders around the world. Sign-up for exclusive signals to give you the edge. Currently available.

GH Garrett – Veteran Commodity Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”