**** Important – I will be out of the office next week, no posts July 20 – 25!

Model Portfolios: Gold = Bullish 6/04, S&P 500= flat 6/09, VIX= waiting for new entry.

Nonlinear Trading Themes:

Gold: Gold continues to grind lower. Today’s price action dipper below the 110 level. I don’t expect it to stay this low, we should see a modest rally from this level. The gold model portfolio is long.

Gold: Gold continues to grind lower. Today’s price action dipper below the 110 level. I don’t expect it to stay this low, we should see a modest rally from this level. The gold model portfolio is long. S&P 500: The S&P 500 is now at the top end of the range. I expect some selling to come in at these levels but there is a twist. The VIX readings are very neutral. Taken at face values, the large-cap index should give back some of the week’s gains but not retest the 2040 level. The S&P 500 portfolio is flat.

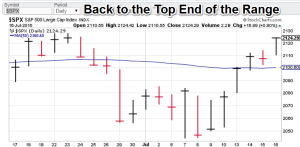

S&P 500: The S&P 500 is now at the top end of the range. I expect some selling to come in at these levels but there is a twist. The VIX readings are very neutral. Taken at face values, the large-cap index should give back some of the week’s gains but not retest the 2040 level. The S&P 500 portfolio is flat.- $VIX (S&P volatility): Pre-production VIX is flat, thus indicating limited downside for stoacks. I am waiting for a VIX signal (post 2.0).

Note: Technical comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as the Bond trading signals.

GH Garrett – Veteran Commodity Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”