Model Gold Portfolios: Gold = Bullish 6/04, S&P 500= flat 6/09, VIX= designing model.

Nonlinear Trading Themes:

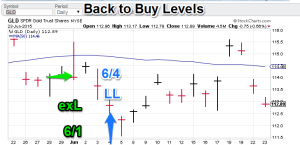

Gold: The recent breakout failed as the media touted a Monday morning turn-for the-better in Euro-Greece debt negotiations. It looked like another game of kick-the-can to me. But clearly my skepticism is in the minority as gold dropped heavily in the aftermath (Monday and Tuesday). Today’s closing level is very close to the previous buy level on the GLD (June 4th). The current theme is still bullish with an oversold feel to it. The model Gold portfolio is still bullish

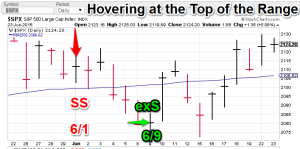

Gold: The recent breakout failed as the media touted a Monday morning turn-for the-better in Euro-Greece debt negotiations. It looked like another game of kick-the-can to me. But clearly my skepticism is in the minority as gold dropped heavily in the aftermath (Monday and Tuesday). Today’s closing level is very close to the previous buy level on the GLD (June 4th). The current theme is still bullish with an oversold feel to it. The model Gold portfolio is still bullish S&P 500: Largecaps, laboriously, ticked higher on the Greek-feel-good news but the S&P closed about where it did last Thursday (June 18th). Maybe the good-times are still to come. The current read is still that we are range-bound. Recent trading activity has us hovering near the top end of the range. Translation: ‘be careful about buying here.’ The S&P 500 model is still flat.

S&P 500: Largecaps, laboriously, ticked higher on the Greek-feel-good news but the S&P closed about where it did last Thursday (June 18th). Maybe the good-times are still to come. The current read is still that we are range-bound. Recent trading activity has us hovering near the top end of the range. Translation: ‘be careful about buying here.’ The S&P 500 model is still flat.- $VIX (S&P volatility): Largecap price compression is the opposite of healthy for volatility. The preproduction VIX trading model exited a useful short (it is now flat) but the index still moved lower. There is no indication of an upside reversal yet.

Note: Technical comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as the Bond trading signals.

GH Garrett – Veteran Commodity Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”