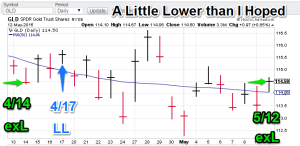

Model Gold Portfolios: Gold = Exit Long 5/12, S&P 500 awaiting revisions

Technical Read:

Gold: The yellow metal tested the 113 (GLD basis) support level several times over the last 15-days and rallied to modestly higher levels. (Putin is going to meet with Kerry, I hope the Earth does not explode when those egos are in the in the same place). However, nonlinear trading analysis has signaled to move us to neutral with today’s data. This is the first signal from the major revision (2.0). I suspect we will be getting more frequent signals going forward but we will have to see. Model Gold portfolio is now flat.

Gold: The yellow metal tested the 113 (GLD basis) support level several times over the last 15-days and rallied to modestly higher levels. (Putin is going to meet with Kerry, I hope the Earth does not explode when those egos are in the in the same place). However, nonlinear trading analysis has signaled to move us to neutral with today’s data. This is the first signal from the major revision (2.0). I suspect we will be getting more frequent signals going forward but we will have to see. Model Gold portfolio is now flat.- S&P 500: I am refitting the S&P models with the (2.0) revision, I expect to have this chart back online sometime next week. There will be another 30-day trial. If all goes well, my next project (you may want to sit down before reading further) will be largecap volatility ($VIX). I have been doing volatility related work recently. Can nonlinear trading analysis provide insight into future volatility spikes? I will be finding out.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as the bond trading signals. Currently available.

GH Garrett – Veteran Commodity Watcher for Conquer the Mummy .com “Nonlinear signals that matter in gold trading.”