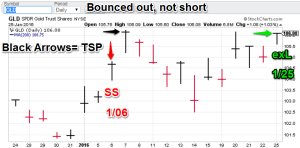

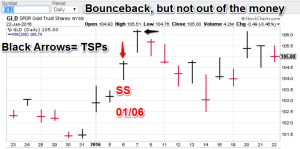

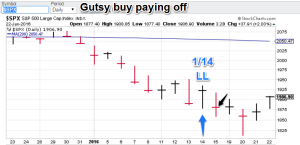

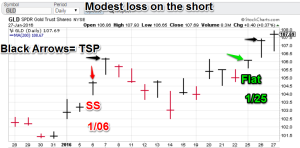

Model Notes: Gold took an unfriendly bounce on the Tuesday the 26th (the TSP day) closing the recent short out with a modest lost. I guess you can’t win them all. The S&P closed the trading day right at our TSP entry level. Stocks are struggling to gain traction. The July wheat signal is a little underwater but the signal was just issued on Friday. Finally, our bond signal goes online today with a sell signal after a day of mixed trading.

Current Market rotation: Featured S&P (US Bonds for Feb), Core market rotation: Gold (wheat for Feb)

Model Portfolio Signals: (Gold, GLD basis) flat signal = 1/25 (TSP=107.29).The $S&P is now long 1/14 (TSP=1880.33). Wheat long signal 1/22 (TSP= 492), TLO Short 1/27 (TSP=waiting)

Note: TSP is calculated by using the closing price of the trading day after the signal day. It is more realistic for trading calculations/evaluations.

Nonlinear Trading Themes:

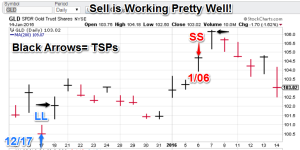

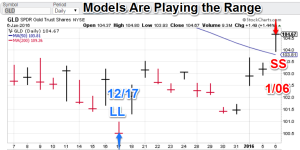

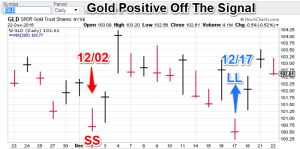

Gold (current core market): I could tell soothing was not going right with the previous short as the prices kept advancing after a reasonable decline. The exit signal came about the same level as the sell short, however the exit day was quite strong. This core market is rotating out for Feb, but it will be back for March. Flat, flat, flat.

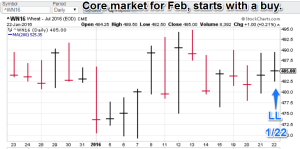

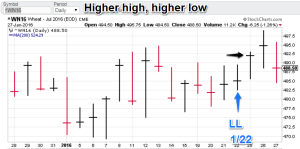

Gold (current core market): I could tell soothing was not going right with the previous short as the prices kept advancing after a reasonable decline. The exit signal came about the same level as the sell short, however the exit day was quite strong. This core market is rotating out for Feb, but it will be back for March. Flat, flat, flat. Wheat (Feb core market): over the last month of trading this market has drifted up from the Jan. 7 lows. The buyers are still in control. Still long.

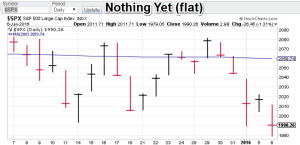

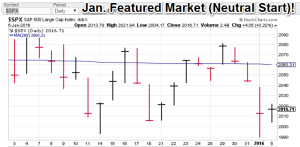

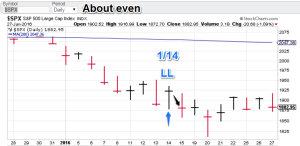

Wheat (Feb core market): over the last month of trading this market has drifted up from the Jan. 7 lows. The buyers are still in control. Still long. S&P 500 (Jan. featured market): We missed the early month decline in stocks (flat during the time), however Jan. 14 buy is struggling. We are about even for the trade (TSP level). But what does tomorrow bring? The models are long.

S&P 500 (Jan. featured market): We missed the early month decline in stocks (flat during the time), however Jan. 14 buy is struggling. We are about even for the trade (TSP level). But what does tomorrow bring? The models are long. US Bonds (Feb Feature): The market (TLO basis) has been moving up but recently the momentum is starting to wane. The models start this market off with a sell.

US Bonds (Feb Feature): The market (TLO basis) has been moving up but recently the momentum is starting to wane. The models start this market off with a sell.

Note: Non linear trading theme comments are based on interpretations of non-linear trading models, combined with chart price action (technical analysis).

Premium offers:

- I am now offering reasonable rates to institutional clients. Click on the ‘Fees’ tab for more info. I have a limited number of slots to fill.

- With deflationary forces becoming more dominant, top level, successful, investment strategies are going to become more reliant on ‘activity’ (trading). Check out ConquerTheMummy.com for trading signals that help!

- Remember: Nonlinear trading analysis is “insider knowledge” (non-apparent) for standard technical analysis.

- The post-mortems for the recent US dollar and the VIX featured markets have been posted. To view it select the “Forex” or “US Equity” tabs (respectively) on ConquerTheMummy.com.

GH Garrett – Veteran Market Watcher for ConquertheMummy.com © 2015-2016, “Nonlinear signals that matter in gold (and wheat) trading.”