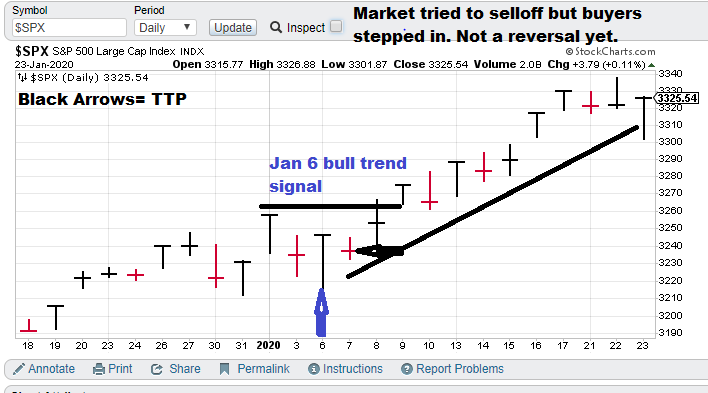

1-month (approx.) focus chart.

Current S&P 500 Prediction (slow model): $SPX (S&P 500), Bull-trend signal (01/06/20), TTP= 3237.18

Current price for CTM research (signals), $20,000 per quarter for the S&P 500 “fast” nonlinear model. The faster model is more optimized for options trading.

Model notes: We are still on track with our 2020 signal. Prices broke out, climbed higher, we seem to be pausing but the signal is still prescient. I continue to have faith in chaotic trend / nonlinear trend analysis approach. I am pretty excited about where we are on the models.

What does the S&P 500 say about … Trump impeachment? Market usually hate uncertainty, so the uptrend seems to be indicating the Democratic pseudo-coup not going to succeed.

Note: The following comments are based on using technical analysis to ‘flesh out’ our nonlinear trading signals. TTP (Theoretical Transaction Day) is defined as the closing price on the day following the signal day.

Nonlinear Trading Themes:

S&P 500 forecast (Bullish, SPX): Someone hit the “pause” button on the new year’s rise. On the other hand, the current market action does not seem to look like a reversal. Nonlinear trend / Chaotic trend analysis is indicating the uptrend is still in place, So let’s see if the pause starts to resolve upwards.

Master Sergeant Bilko (the movie version) said, “I like a sporting event in which I know the outcome beforehand, it’s more organized.”

GH Garrett – Chief Market Analyst for ConquertheMummy.com © 2015-2020, “Nonlinear trading signals that matter in stock index and S&P 500 trading. Determine the future direction of the S&P and trading becomes much less complex.”