Current Model positions:

- Equity buy signal date= 10/11, TSP = Waiting

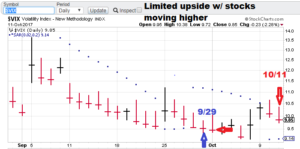

- Vix sell signal date= 10/11, TSP = waiting

- $TNX (rates) signal date = 10/02, TSP = 23.34

Model notes: Models now confirming uptrend for blue ships.

Note: The following comments are based on using technical analysis to ‘flesh out’ our nonlinear trading signals. TSP is defined as the closing price following the signal day.

Nonlinear Trading Themes:

Bullish Yields ($TNX): Rates are still drifting upward. Models and short-term trendlines confirm this. One uncertainty now appearing in the press is speculation on Yellan’s replacement. Don’t-Rock-the-Yellan’s days as the leader of the Fed look to be coming to an end.

Bullish Yields ($TNX): Rates are still drifting upward. Models and short-term trendlines confirm this. One uncertainty now appearing in the press is speculation on Yellan’s replacement. Don’t-Rock-the-Yellan’s days as the leader of the Fed look to be coming to an end. Bullish Trend Stocks (SPY): The previous sell signal was not very helpful and bluechips took a leg higher. The models respect the market’s strength and have now reversed. Upside is now the path of least resistance.

Bullish Trend Stocks (SPY): The previous sell signal was not very helpful and bluechips took a leg higher. The models respect the market’s strength and have now reversed. Upside is now the path of least resistance. Bearish Trend Equity volatility ($VIX): Volatility has very limited upside with stock moving higher. We look for lower values here.

Bearish Trend Equity volatility ($VIX): Volatility has very limited upside with stock moving higher. We look for lower values here.

Premium Research notes:

Observation: We are changing our premium services for 2017. Stay tuned for the details of the new service to be offered. Get your independent research here, put my 25+ years of model building experience to work for you!

Take a minute to peruse the US Equities tab. I posted the S&P 500 trading signals postmortem for the recent March-April time period (approx. as it took about a week to generate a signal at the beginning). Plus 134 Points. Great stuff!

Take a minute to check out the Forex tab on our website. I am posting the recent US Dollar May-June signals. No whipsaws and playing the surprise Brexit vote just right. Great stuff!

Take a minute to take a minute to click on our bond trading tab. Our signals took the profits in the early month while holding the long interest rates position later. It never sold rates, hinting at higher rates to come. The TBT went higher outside our test window. A nice tip-off for the future!

Check out the energy tab. We tracked crude during the run up to the US presidential election. There was plenty negativity with a surprise ending. See how nonlinear analysis walked us through it!

GH Garrett – Chief Market Analyst for ConquertheMummy.com © 2015-2017, “Nonlinear trading signals that matter in VIX trading.”