July-Aug Rotations: Core Mkt = GLD, Featured Mkt = TBT.

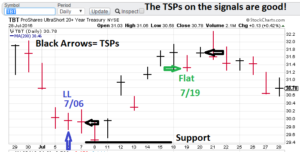

Signals: GLD = Flat (TSP= N/A), TBT= Flat 7/19 (TSP= 31.71).

Model notes: The TBT is retreating (meaning rates are going down) in the aftermath of the July 19 sell. The TSP values of the trades this month have been great with the ‘long’ entry TSP at the second lowest close of the month so far. The July 19 exit (flat) TSP was the second highest of the month so far. Buy low, exit high. This model is in sync. What about the yellow metal? We are still waiting on a high confidence signal here. The plus side is that the market is near its start point (June 30). So in its own way the model is in sync too.

Note: The TSP (theoretical Signal Price) metric is calculated by using the ‘close’ price of the trading day FOLLOWING the signal day (giving you plenty of time to take the signal).

Note: The following comments are based on using technical analysis to ‘flesh out’ our nonlinear trading signals.

Nonlinear Trading Themes:

Gold Trading Signals (Core). GLD reversed to the downside today but we have pretty solid support just 2 points lower. This doesn’t seem like a lucrative opportunity yet (either way). For now, the model gold portfolio is flat.

Gold Trading Signals (Core). GLD reversed to the downside today but we have pretty solid support just 2 points lower. This doesn’t seem like a lucrative opportunity yet (either way). For now, the model gold portfolio is flat. Interest Rates (Featured). Our July 19 exit signal caught a favorable bounce to exit at the next day’s close. Since then the TBT has been headed down. Support at 29.5. The model interest rate portfolio is flat the TBT.

Interest Rates (Featured). Our July 19 exit signal caught a favorable bounce to exit at the next day’s close. Since then the TBT has been headed down. Support at 29.5. The model interest rate portfolio is flat the TBT.

Premium Research notes:

Observation: Don’t sit around your Monday morning meetings giving each other high-fives with a two-star fund or strategy on the books. Contact me for more info. Click the ‘Ranking’ tab to find out more. By the way, in 2016, I am only going to take on 6 clients. CTM can help and our rates are reasonable!

We are now offering asset class ranking (or alternatively sector ranking), using our trading signal technology on a longer timeframe. This is an exciting new product as portfolio construction has one glaring, missing puzzle piece: what asset classes will continue to outperform/advance for next month? Get your independent research here, put my 25+ years of model building experience to work for you!

Take a minute to peruse the US Equities tab. I posted the S&P 500 trading signals postmortem for the recent March-April time period (approx. as it took about a week to generate a signal at the beginning). Plus 134 Points. Great stuff!

Take a minute to check out the Forex tab on our website. I am posting the recent US Dollar May-June signals. No whipsaws and playing the surprise Brexit vote just right. Great stuff!

GH Garrett – Chief Market Analyst for ConquertheMummy.com © 2015-2016, “Nonlinear trading signals that matter in gold (and interest rate) trading.”