Model Notes: The markets we are following for March are both at the top end of the monthly range (stocks maybe a little stronger, but a little more overbought). I am waiting for some reconfirmation signal to initiate the positions for the new month.

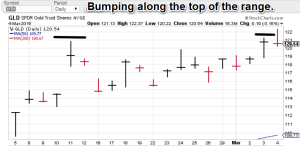

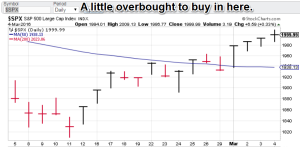

March Rotations: Core Gold, Featured: S&P 500.

Model Portfolio Signals: GLD flat, S&P 500 flat

Note: TSP is calculated by using the closing price of the trading day after the signal day. It is more realistic for trading calculations/evaluations.

Nonlinear Trading Themes:

Gold (Mar core market) Gold tried to breakout of its monthly range on Friday, but ended up reversing as stocks held up well. 122 may be near-term resistance (GLD basis). Gold model is flat.

Gold (Mar core market) Gold tried to breakout of its monthly range on Friday, but ended up reversing as stocks held up well. 122 may be near-term resistance (GLD basis). Gold model is flat. S&P 500 (Mar feature): Stocks are holding up well but buying after a 4-day advance may not be a good trading move. A new week is coming. S&P 500 is flat.

S&P 500 (Mar feature): Stocks are holding up well but buying after a 4-day advance may not be a good trading move. A new week is coming. S&P 500 is flat.

Note: Non linear trading theme comments are based on interpretations of non-linear trading models, combined with chart price action (technical analysis).

Premium offers:

- I am now offering reasonable rates to institutional clients. Click on the ‘Fees’ tab for more info. I have a limited number of slots to fill.

- With deflationary forces becoming more dominant, top level, successful, investment strategies are going to become more reliant on ‘activity’ (trading). Check out ConquerTheMummy.com for trading signals that help!

- Remember: Nonlinear trading analysis is “insider knowledge” (non-apparent) for standard technical analysis.

- The post-mortems for the recent US dollar and the VIX featured markets have been posted. To view it select the “Forex” or “US Equity” tabs (respectively) on ConquerTheMummy.com.

GH Garrett – Veteran Market Watcher for ConquertheMummy.com © 2015-2016, “Nonlinear signals that matter in gold (and wheat) trading.”