Model Notes: The equity selloff really seems to have disrupted the flow of markets in general, switching the focus to a pair of odd bedfellow (oil and Chinese equities). February was a tough month. I hope to use lessons learned for more dramatic advantage going forward in 2016!

Current Market rotation: Core: Wheat. Featured: US Bonds.

Next rotation for March: Core Gold, Featured: S&P 500.

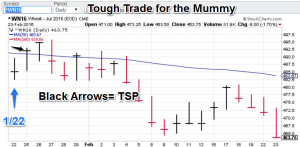

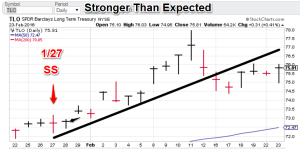

Model Portfolio Signals: Wheat long signal 1/22 (TSP= 492), TLO Short 1/27 (TSP=72.81)

Note: TSP is calculated by using the closing price of the trading day after the signal day. It is more realistic for trading calculations/evaluations.

Nonlinear Trading Themes:

Wheat (Feb core market): This is a new core market for us. Deflationary forces were not our friends on this one. We wave bye to this but will be following again in April.

Wheat (Feb core market): This is a new core market for us. Deflationary forces were not our friends on this one. We wave bye to this but will be following again in April. US Bonds (Feb Feature): US Bonds (TLO basis), advanced despite the Fed bias shifting to ‘tightening’ (generally bearish for debt). This market remains my white whale. Our featured market for March will be the S&P 500.

US Bonds (Feb Feature): US Bonds (TLO basis), advanced despite the Fed bias shifting to ‘tightening’ (generally bearish for debt). This market remains my white whale. Our featured market for March will be the S&P 500.

Note: Non linear trading theme comments are based on interpretations of non-linear trading models, combined with chart price action (technical analysis).

Premium offers:

- I am now offering reasonable rates to institutional clients. Click on the ‘Fees’ tab for more info. I have a limited number of slots to fill.

- With deflationary forces becoming more dominant, top level, successful, investment strategies are going to become more reliant on ‘activity’ (trading). Check out ConquerTheMummy.com for trading signals that help!

- Remember: Nonlinear trading analysis is “insider knowledge” (non-apparent) for standard technical analysis.

- The post-mortems for the recent US dollar and the VIX featured markets have been posted. To view it select the “Forex” or “US Equity” tabs (respectively) on ConquerTheMummy.com.

GH Garrett – Veteran Market Watcher for ConquertheMummy.com © 2015-2016, “Nonlinear signals that matter in gold (and wheat) trading.”