Model Notes: Again both models are in reasonable positions versus the current markets. Gold is fully reversing back to a long signal as of today, while the Brazilian real signal went flat earlier in the week. We can evaluate the gold trade when the theoretical signal price (TSP) becomes known tomorrow. The recent ‘real’ signal was a mildly positive trade (TSP to TSP). So we are holding our own on the signal front despite the Fed seemingly historic bias change. Historic? Well after all the months of talking, it sure feels historic.

Featured market rotation: .Brazilian real for December. S&P for January(!). Gold is currently non-rotational.

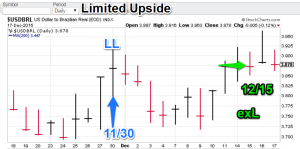

Model Portfolio Signals: (Gold) buy signal = 12/17 (TSP=waiting), The Brazilian real is going flat today12/15 (TSP=3.883).

Note: TSP is calculated by using the closing price of the trading day after the signal day. It is more realistic for trading calculations.

Nonlinear Trading Themes:

Gold: Gold busted a gut to the downside today putting the GLD near its 100.50 near-term support level. The models flipped from a short to long bais on today’s action. With the Christmas vacations looming, one would hope serious selling would dry up. The model gold portfolio is now long.

Gold: Gold busted a gut to the downside today putting the GLD near its 100.50 near-term support level. The models flipped from a short to long bais on today’s action. With the Christmas vacations looming, one would hope serious selling would dry up. The model gold portfolio is now long. Brazilian Real (Dec. Featured Market): On the Dec 16, the ‘real’ spiked and then sold way off those intra-day highs. The models are mixed on this market (and we are now flat) so we expect the recent resistance level to be a problem for the bulls (not to mention the strength of the US dollar over the last week). Range bound is the likely call for now. The real model is now flat.

Brazilian Real (Dec. Featured Market): On the Dec 16, the ‘real’ spiked and then sold way off those intra-day highs. The models are mixed on this market (and we are now flat) so we expect the recent resistance level to be a problem for the bulls (not to mention the strength of the US dollar over the last week). Range bound is the likely call for now. The real model is now flat.

Note: Non linear trading theme comments are based on interpretations of non-linear trading models, combined with chart price action (technical analysis).

Premium offers:

- I am now offering a more a la carte fee system for CTM research. Purchasers can now mix and match signals on various symbols that are currently available. Click on the ‘Fees’ tab for more info.

- With deflationary forces becoming more dominant, top level, successful, investment strategies are going to become more reliant on ‘activity’ (trading). Check out ConquerTheMummy.com for trading signals that help!

- Remember: Nonlinear trading analysis is “insider knowledge” (non-apparent) for standard technical analysis.

- The post-mortems for the recent US dollar and the VIX featured markets have been posted. To view it select the “Forex” or “US Equity” tabs (respectively) on ConquerTheMummy.com.

GH Garrett – Veteran Market Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”