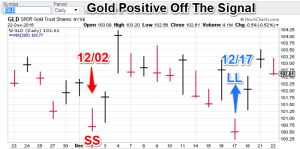

Model Notes: December is proving to be a dry well for the models. First gold. The ‘snapback’ day after the 12/17 reverse to long entry gave us a narrow loss on the previous short signal, price to price using the theoretical signal price (TSP to TSP). Since the reversal signal came at the monthly low (good). Since then prices are higher. The model is still in synch. Next the Brazilian real. The 11/30 entry to the 12/15 exit was narrowly positive (good) but in the aftermath of the signal. Prices went higher. This is okay, but a little disappointing given the previous meager profit. Oh well. Looking on the bright side, we are nearing the Christmas Day observance of the birth of the savior. A time of good cheer and gift giving, so we are wishing you a MERRY Christmas!

If you find yourself with an extra hour and a half on your hands, I would recommend going to this link : http://florida.thejoyfm.com/headline/a-christmas-carol for a particularly powerful audio rendition of the classic “Christmas Carol” story. This should not fail to enhance your Christmas season spirit.

Featured market rotation: Brazilian real for December. S&P for January(!). Gold is currently non-rotational.

Model Portfolio Signals: (Gold, GLD basis) buy signal = 12/17 (TSP=102.04), The Brazilian real is going flat today12/15 (TSP=3.883).

Note: TSP is calculated by using the closing price of the trading day after the signal day. It is more realistic for trading calculations.

Nonlinear Trading Themes:

Gold: Gold popped up after the buy signal though there was some giveback today. The 100.50 support level has now been tested twice and held. This puts the yellow metal on a positive bias going into the holidays. The model gold portfolio remains long.

Gold: Gold popped up after the buy signal though there was some giveback today. The 100.50 support level has now been tested twice and held. This puts the yellow metal on a positive bias going into the holidays. The model gold portfolio remains long. Brazilian Real (Dec. Featured Market): The exit long on the Dec 16 took advantage of an overbought market bumping its head against recent resistance but the market still climbed. The models are skeptical for the bulls. The real model is remains flat.

Brazilian Real (Dec. Featured Market): The exit long on the Dec 16 took advantage of an overbought market bumping its head against recent resistance but the market still climbed. The models are skeptical for the bulls. The real model is remains flat.

Note: Non linear trading theme comments are based on interpretations of non-linear trading models, combined with chart price action (technical analysis).

Premium offers:

- I am now offering a more a la carte fee system for CTM research. Purchasers can now mix and match signals on various symbols that are currently available. Click on the ‘Fees’ tab for more info.

- With deflationary forces becoming more dominant, top level, successful, investment strategies are going to become more reliant on ‘activity’ (trading). Check out ConquerTheMummy.com for trading signals that help!

- Remember: Nonlinear trading analysis is “insider knowledge” (non-apparent) for standard technical analysis.

- The post-mortems for the recent US dollar and the VIX featured markets have been posted. To view it select the “Forex” or “US Equity” tabs (respectively) on ConquerTheMummy.com.

GH Garrett – Veteran Market Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”