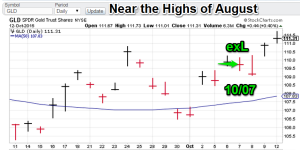

Model Notes: The gold model is doing well. The recent exit was well north of the entry (TSP to TSP). Following the exit, GLD moved up but there is significant resistance at these levels. Bonds are more problematical. The 9/24 signal (and the resulting poor TSP) has spent 2 weeks “out of the money.” On the plus side, the Oct 2nd downside reversal has capped the rally (remember we are short). The signal still points down, hence the “waiting game” comment.

Featured market rotation: US Dollar for September (nearing the end) and Bonds for October. VIX for November. Brazilian real for December. Gold is currently non-rotational.

Model Portfolio Signals: (Gold) Exit Long= 10/07 (TSP=waiting), (Bonds/TLO) Sell =9/24 (TSP= 70.36)

Note: TSP is calculated by using the close of the trading day after the signal day.

Nonlinear Trading Themes:

Gold: The yellow metal (GLD basis) is now near a multi-month high not seen since the dark days of the Chinese (followed by the S&P 500) stock market sell-off. But while gold is at these levels again, the S&P 500 is making gains to retrace to pre-crash levels. So being flat is not an unpleasant situation. The model gold portfolio remains flat.

Gold: The yellow metal (GLD basis) is now near a multi-month high not seen since the dark days of the Chinese (followed by the S&P 500) stock market sell-off. But while gold is at these levels again, the S&P 500 is making gains to retrace to pre-crash levels. So being flat is not an unpleasant situation. The model gold portfolio remains flat. Bonds (Oct Featured Market): The TLO is higher than the 9/24 TSP level, but not really running away. The model sees higher rates (lower bonds). A logic walk-through goes like this: The Fed wants to do the lone rate hike but has been stymied by recent bad jobs data and “advice” from both the World and IMF (peer pressure). The Fed wants to do the hike as the endless speculation on whether they do it or not has become counter-productive (they promised to do one soon). The recent rally in stocks (aka a prominent leading indicator of the economy) will give them the cover to act. The model bond portfolio remains bearish.

Bonds (Oct Featured Market): The TLO is higher than the 9/24 TSP level, but not really running away. The model sees higher rates (lower bonds). A logic walk-through goes like this: The Fed wants to do the lone rate hike but has been stymied by recent bad jobs data and “advice” from both the World and IMF (peer pressure). The Fed wants to do the hike as the endless speculation on whether they do it or not has become counter-productive (they promised to do one soon). The recent rally in stocks (aka a prominent leading indicator of the economy) will give them the cover to act. The model bond portfolio remains bearish.

Note: Technical analysis comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- I am now offering a more a la carte fee system for CTM research. Purchasers can now mix and match signals on various symbols. Currently available. Click on the ‘Fees’ tab for more info.

- With deflationary forces becoming more dominant, top level, successful, investment strategies are going to become more reliant on ‘activity’ (trading). Check out ConquerTheMummy.com for trading signals that help!

- Remember: Nonlinear trading analysis is “insider knowledge” (non-apparent) for standard technical analysis .

- The post-mortem for the US dollar has been posted. To view it select the “Forex” tab on ConquerTheMummy.com.

GH Garrett – Veteran Market Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”