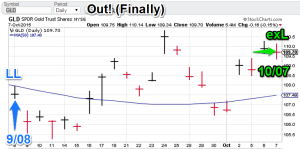

Model Notes: The gold model did a pretty good job over the last month. The entry TSP of 106.13 (GLD basis) was at the low end of the 30-day trading range. We won’t know what the exit long TSP is until after the close of tomorrow, but if it is near the 2 previous closing prices, it will be near the high end of the same 30-day range. This is very good performance.

Featured market rotation: US Dollar for September (nearing the end) and Bonds for October. Stocks for November. Brazilian real for December. Gold is currently non-rotational.

Model Portfolio Signals: (Gold) Exit Long= 10/07 (TSP=waiting), (Bonds/TLO) Sell =9/24 (TSP= 70.36)

Note: TSP is calculated by using the close of the trading day after the signal day.

Nonlinear Trading Themes:

Gold: Poor jobs data really change the gold trading dynamic, sending the yellow metal higher. Today’s exit long signal is a recognition that gold is becoming more vulnerable to a retrenchment. Especially, if stocks keep the rally going. The model gold portfolio is now flat.

Gold: Poor jobs data really change the gold trading dynamic, sending the yellow metal higher. Today’s exit long signal is a recognition that gold is becoming more vulnerable to a retrenchment. Especially, if stocks keep the rally going. The model gold portfolio is now flat. Bonds (Oct Featured Market): The 9/24 sell signal is shackled with a less-than-optimal TSP. Nevertheless, the models see more downside ahead. If stocks continue to pick up the tail wind, the Fed may be emboldened to squeeze out a hike this year after all. The IMF disagrees, as Jose Vinals (Monetary and Capital Markets Director), advised against a Fed nudge. Oh well, as the saying goes, those that can “do”, and those that can’t give advice to the Fed. The TLO has been trading below the 72 resistance level (TLO basis) for several days now. The model bond portfolio remains bearish.

Bonds (Oct Featured Market): The 9/24 sell signal is shackled with a less-than-optimal TSP. Nevertheless, the models see more downside ahead. If stocks continue to pick up the tail wind, the Fed may be emboldened to squeeze out a hike this year after all. The IMF disagrees, as Jose Vinals (Monetary and Capital Markets Director), advised against a Fed nudge. Oh well, as the saying goes, those that can “do”, and those that can’t give advice to the Fed. The TLO has been trading below the 72 resistance level (TLO basis) for several days now. The model bond portfolio remains bearish.

Note: Technical analysis comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- I am now offering a more a la carte fee system for CTM research. Purchasers can now mix and match signals on various symbols. Currently available. Click on the ‘Fees’ tab for more info.

- With deflationary forces becoming more dominant, top level, successful, investment strategies are going to become more reliant on ‘activity’ (trading). Check out ConquerTheMummy.com for trading signals that help!

- Remember: Nonlinear trading analysis is “insider knowledge” (non-apparent) for standard technical analysis .

- The post-mortem for the US dollar has been posted. To view it select the “Forex” tab on ConquerTehMummy.com.

GH Garrett – Veteran Market Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”