Model Gold Portfolios: Gold = Flat 6/01, S&P 500 – Bearish 6/01, VIX – designing model.

Technical Read:

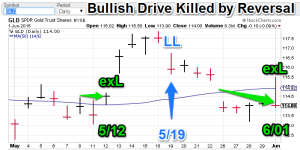

Gold: Gold exploded in early trading but spent the rest of the day slowly selling back, then posting a mild loss (.GLD basis, -.10). Nonlinear trading signals are trendless. The 113 support line may soon find itself tested again. I am not sure it will hold this time around. The model Gold portfolio is now flat.

Gold: Gold exploded in early trading but spent the rest of the day slowly selling back, then posting a mild loss (.GLD basis, -.10). Nonlinear trading signals are trendless. The 113 support line may soon find itself tested again. I am not sure it will hold this time around. The model Gold portfolio is now flat. S&P 500: Today’s calculations are even less positive for large-caps. Non liniear trading signals are bearish. This V2.0 sell has been long awaited. The S&P 500 model is now bearish. Let the out of sample data testing begin!

S&P 500: Today’s calculations are even less positive for large-caps. Non liniear trading signals are bearish. This V2.0 sell has been long awaited. The S&P 500 model is now bearish. Let the out of sample data testing begin!- $VIX (S&P volatility): While posting Vix signals is still weeks off, I am running the models and they are generally positive on volatility. Another indication that stock are in danger here.

Note: Technical comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as

GH Garrett – Veteran Commodity Watcher for ConquertheMummy.com ©, “Nonlinear signals that matter in gold trading.”