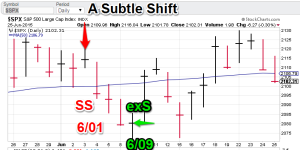

Model Gold Portfolios: Gold = Bullish 6/04, S&P 500= flat 6/09, VIX= designing model.

Nonlinear Trading Themes:

Gold: Greek-Euro negotiation euphoria set sail on the back of the nitty gritty details of the deal, but gold continues to tick lower. Nonlinear trading analysis still has this oversold. The selling over last two trading days features decreasing downside momentum (sometimes a precursor to a reversal). Longer-term analysis is also constructive. We are in a buying zone. The model Gold portfolio is still bullish.

Gold: Greek-Euro negotiation euphoria set sail on the back of the nitty gritty details of the deal, but gold continues to tick lower. Nonlinear trading analysis still has this oversold. The selling over last two trading days features decreasing downside momentum (sometimes a precursor to a reversal). Longer-term analysis is also constructive. We are in a buying zone. The model Gold portfolio is still bullish. S&P 500: Large-caps were less sanguine about the downgrade of a positive Greek-Euro deal. The S&P sold off mildly to the middle of the recent trading range. Nonlinear trading analysis is beginning to hint (not yet confirm) that blue chips won’t have the energy to move lower than the recent bottom (2075 ,SPX basis). So the best approach is to give stocks a couple more days to bottom and see if a buy could be in the offing. The S&P 500 model is still flat.

S&P 500: Large-caps were less sanguine about the downgrade of a positive Greek-Euro deal. The S&P sold off mildly to the middle of the recent trading range. Nonlinear trading analysis is beginning to hint (not yet confirm) that blue chips won’t have the energy to move lower than the recent bottom (2075 ,SPX basis). So the best approach is to give stocks a couple more days to bottom and see if a buy could be in the offing. The S&P 500 model is still flat.- $VIX (S&P volatility): The pre-production VIX trading model has also suggested limited upside (though an upside retest of 15.75 on the $VIX is not impossible). The basic move here is opposite the S&P 500 strategy.

Note: Technical comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as the Bond trading signals.

GH Garrett – Veteran Commodity Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”