Model Gold Portfolios: Gold = Long 5/19, S&P 500 awaiting signal, VIX designing model.

Technical Read:

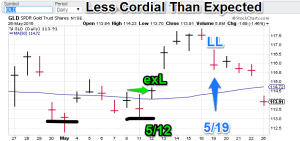

Gold: The tag line refers to a quote in the movie “Braveheart” (when Wallace disrespects an opposing British commander during a parlay). The basic setup a week ago was buying weakness in a perceived uptrend. This was accomplished with a signal change on 5/19. Today’s drop was a little more than expected. However, the yellow metal has reached local support (113 GLD basis) and is now oversold on a near-term basis. Expectations are we will now pick up some buying. The model Gold portfolio is still long.

Gold: The tag line refers to a quote in the movie “Braveheart” (when Wallace disrespects an opposing British commander during a parlay). The basic setup a week ago was buying weakness in a perceived uptrend. This was accomplished with a signal change on 5/19. Today’s drop was a little more than expected. However, the yellow metal has reached local support (113 GLD basis) and is now oversold on a near-term basis. Expectations are we will now pick up some buying. The model Gold portfolio is still long.- S&P 500: The S&P dropped quite a bit today as well. I am still looking for an entry with the model. I am still waiting.

- $VIX (S&P volatility): I am still working on this model for future posting. Volatility jumped as the S&P fell, this is normal for the index. Project is to start posting this in late-June.

Note: Technical comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as

GH Garrett – Veteran Commodity Watcher for ConquertheMummy.com ©, “Nonlinear signals that matter in gold trading.”