Model Gold Portfolios: Gold = Now Long 4/17, S&P 500 = Long 4/7

Technical Read:

Gold: 114.50 has held better than expected over the past several days (and 4/9 too). “Grexit” concerns may be at play here. Nonlinear trading analysis is now signaling higher prices. With local support at 114.50 and 113 (GLD basis), the stage is set for bullish action ahead. Maybe the river that runs still, runs deep. The model gold portfolio is signaled to long today.

Gold: 114.50 has held better than expected over the past several days (and 4/9 too). “Grexit” concerns may be at play here. Nonlinear trading analysis is now signaling higher prices. With local support at 114.50 and 113 (GLD basis), the stage is set for bullish action ahead. Maybe the river that runs still, runs deep. The model gold portfolio is signaled to long today. S&P 500: Largecaps cracked ahead of possible weekend stress. We are still mildly higher than the signal level. We need a few more trading days to give us clearer indications. Ahead. Interest rates and the US dollar are not spiraling. The model largecap portfolio is long.

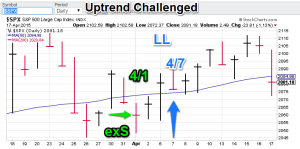

S&P 500: Largecaps cracked ahead of possible weekend stress. We are still mildly higher than the signal level. We need a few more trading days to give us clearer indications. Ahead. Interest rates and the US dollar are not spiraling. The model largecap portfolio is long.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as the bond trading signals. Currently available.

GH Garrett – Veteran Commodity Watcher for Conquer the Mummy .com “Nonlinear signals that matter in gold trading.”