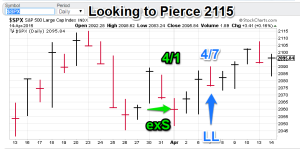

Model Gold Portfolios: Gold = Neutral 4/14, S&P 500 = Long 4/7

Technical Read:

Gold: 114.50 (to the downside). Gold has retreated from recent highs (4/6), not exactly a classic trend reversal but more of a grinding affair. The GLD is resting at near-term support (144.50) with another support area just below (113.50). However, nonlinear trading analysis is no longer supportive. So technical versus nonlinear? The model portfolio is signaled to neutral today. We will have other chances ahead.

Gold: 114.50 (to the downside). Gold has retreated from recent highs (4/6), not exactly a classic trend reversal but more of a grinding affair. The GLD is resting at near-term support (144.50) with another support area just below (113.50). However, nonlinear trading analysis is no longer supportive. So technical versus nonlinear? The model portfolio is signaled to neutral today. We will have other chances ahead. S&P 500: 2115 (to the upside). This signal is doing better than the gold one as largecaps continue to climb. Nonlinear trading analysis is also projecting higher prices. The sellers just don’t seem to be able to put a meaningful raid together with the current setup. The model largecap portfolio is long.

S&P 500: 2115 (to the upside). This signal is doing better than the gold one as largecaps continue to climb. Nonlinear trading analysis is also projecting higher prices. The sellers just don’t seem to be able to put a meaningful raid together with the current setup. The model largecap portfolio is long.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as the bond trading signals. Currently available.

GH Garrett – Veteran Commodity Watcher for Conquer the Mummy .com “Nonlinear signals that matter in gold trading.”