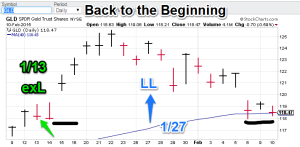

Model Gold Portfolio: Now: Long (Bullish) (1/27)

Technical Read: Gold edged lower today but closed in line with the levels of Jan 14, AKA the last closing trade before the Swiss central bank surprise de-link announcement. This corresponds with the 118 level, GLD basis. Nonlinear trading analysis readings are flat-lining but still positive. The most likely result is a rally from the current oversold levels. Still long.

Technical Read: Gold edged lower today but closed in line with the levels of Jan 14, AKA the last closing trade before the Swiss central bank surprise de-link announcement. This corresponds with the 118 level, GLD basis. Nonlinear trading analysis readings are flat-lining but still positive. The most likely result is a rally from the current oversold levels. Still long.

Backdrop:

- Catalyst 1 – The S&P 500 rallied but the closing price is still contained within the recent range (1990- 2070). This largely neutral for gold (i.e. well behaved price action).

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as the bond trading signals. Currently available.

GH Garrett – Veteran Commodity Watcher for Conquer the Mummy .com “Nonlinear signals that matter in gold trading.”