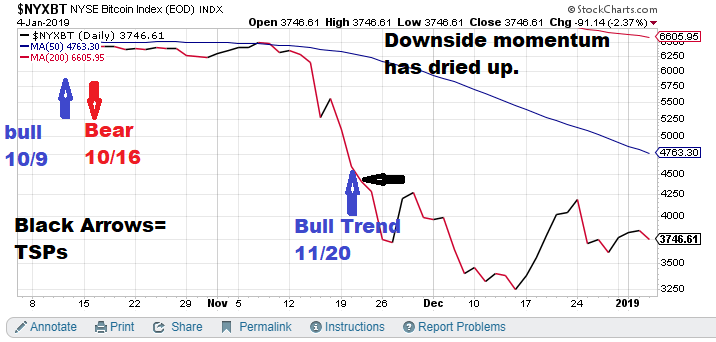

Current Cryptocurrency Prediction:

- $NYXBT (Bitcoin), 11/20/18, bull trend signal. TSP (11/21)= 4409.72.

3-month chart. Current price for 4 symbol package = $7,500 quarterly.

Model notes: This post was made mid-day on March 8 showing EOD chart from March 7th. Model is still in the bull trend mode. The “catch the falling knife” buy (11/20 signal) was a little early, and is still under water but the situation is becoming more positive. Recent nonlinear projections are looking north of the recent 3-mo closing high (approx. 4200). 5000 is not out of the question. The model is still in-synch with the trading.

Note: The following comments are based on using technical analysis to ‘flesh out’ our nonlinear trading signals. TSP is defined as the closing price on the day following the signal day.

Nonlinear Trading Themes:

- Bitcoin forecast ($NYXBT): The fading volatility seen in Jan and early Feb has resolved itself to the upside with near-term trading breaking out above the 3-month down trend line. As stated earlier the nonlinear models are now projecting toward the 5000 range. So we are not looking for the 4200 resistance point to hold.

GH Garrett – Chief Market Analyst for ConquertheMummy.com © 2015-2019, “Nonlinear trading signals that matter in bitcoin trading.”