Dec-Jan Rotations: Core Mkt = Gold, Featured Mkt = Asset class Portfolio.

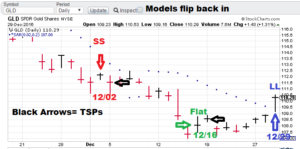

Signals: Gld = Buy 12/29 (TSP= Waiting), AC Portfolio= bought 12/29

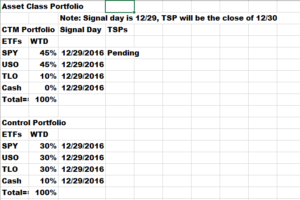

Model notes: We are releasing (first time ever) the sample asset class ranking portfolio. The signal day is 12/29 and the TSP will be the close of 12/20. Since this is a sample of the premium product, we are excited and looking for forward to the performance numbers in January. Remember if the models dictate, we could have a rebalance between now and Jan 31 (the last trading day in January). The gold model also registered a buy. The exit to flat signal on gold proved a good signal but now the models are calling a “buy” indicating some type of bottom is now in.

Note: ALL Mummy calculations use the TSP (Theoretical Signal Price)! The TSP metric is calculated by using the ‘close’ price of the trading day FOLLOWING the signal day (giving you plenty of time to take the signal).

Note: The following comments are based on using technical analysis to ‘flesh out’ our nonlinear trading signals.

Nonlinear Trading Themes:

Gold Trading Signals (Core). The selloff after the Dec 2 “sell” signal and the later “flat” signal (Dec 16) worked well for us. The models are now signaling a “buy” and the clear inference is the recent bottom at 107.50 (GLD basis) is going to be significant.

Gold Trading Signals (Core). The selloff after the Dec 2 “sell” signal and the later “flat” signal (Dec 16) worked well for us. The models are now signaling a “buy” and the clear inference is the recent bottom at 107.50 (GLD basis) is going to be significant. Asset Class Portfolio (Featured). We are posting the buy-in of the CTM sample asset class portfolio ranking. (Do I hear the faint, “It’s about time!”) I wanted to get a reconfirmation before hitting the button and we now have it. The rankings indicate the continuation of the Trump-trade (stocks heading up and bonds on the defensive). What about the Dec 28 selloff? The models are not seeing this as a game changer yet. I have listed three asset classes: SPY (stocks), TLO (bonds) and USO (energy) as well as a control (balanced) portfolio for comparison.

Asset Class Portfolio (Featured). We are posting the buy-in of the CTM sample asset class portfolio ranking. (Do I hear the faint, “It’s about time!”) I wanted to get a reconfirmation before hitting the button and we now have it. The rankings indicate the continuation of the Trump-trade (stocks heading up and bonds on the defensive). What about the Dec 28 selloff? The models are not seeing this as a game changer yet. I have listed three asset classes: SPY (stocks), TLO (bonds) and USO (energy) as well as a control (balanced) portfolio for comparison.

Premium Research notes:

Observation: Is it just me, or would our premium ranking signals make a great (moderately priced) addition to any hedge fund strategy? Don’t sit around your Monday morning meetings giving each other high-fives with a two-star strategy on the books. Nonlinear portfolio construction can give you an edge. Contact me for more info. Click the ‘Ranking’ tab to find out additional info. By the way, in 2017, I am only going to take on 4 clients!

We are now offering asset class ranking (or alternatively sector ranking), using our trading signal technology on a longer timeframe. This is an exciting new product as portfolio construction has one glaring, missing puzzle piece: what asset classes will continue to outperform/advance for next month? Get your independent research here, put my 25+ years of model building experience to work for you!

Take a minute to peruse the US Equities tab. I posted the S&P 500 trading signals postmortem for the recent March-April time period (approx. as it took about a week to generate a signal at the beginning). Plus 134 Points. Great stuff!

Take a minute to check out the Forex tab on our website. I am posting the recent US Dollar May-June signals. No whipsaws and playing the surprise Brexit vote just right. Great stuff!

Take a minute to take a minute to click on our bond trading tab. Our signals took the profits in the early month while holding the long interest rates position later. It never sold rates, hinting at higher rates to come. The TBT went higher outside our test window. A nice tip-off for the future!

Check out the energy tab. We tracked crude during the run up to the US presidential election. There was plenty negativity with a surprise ending. See how nonlinear analysis walked us through it!

GH Garrett – Chief Market Analyst for ConquertheMummy.com © 2015-2016, “Nonlinear trading signals that matter in gold trading.”