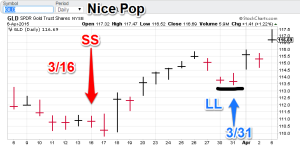

Model Gold Portfolios: Gold = Long 3/31, S&P 500 =Neutral 4/1

Technical Read:

Gold: Gold had a nice pop today. GLD closed off the highs but still north of the most recent established peak (116 on March 26). The trend is up and nonlinear trading analysis is positive, so I expect more upside action. The 113.50 support level is good footing for the rise. Model portfolio is long.

Gold: Gold had a nice pop today. GLD closed off the highs but still north of the most recent established peak (116 on March 26). The trend is up and nonlinear trading analysis is positive, so I expect more upside action. The 113.50 support level is good footing for the rise. Model portfolio is long. S&P 500: Today starts the post-Easter 30-day trial on the S&P 500. I have applied the latest nonlinear trading analysis models. I look forward to the upcoming days. The read is neutral with the last signal being an exit short on 4/1. Largecaps are now signaling they are non-trending, so I do not expect the nearby 2045 (S&P basis) to be pierced. However, it seems too early to go long. Model portfolio is neutral.

S&P 500: Today starts the post-Easter 30-day trial on the S&P 500. I have applied the latest nonlinear trading analysis models. I look forward to the upcoming days. The read is neutral with the last signal being an exit short on 4/1. Largecaps are now signaling they are non-trending, so I do not expect the nearby 2045 (S&P basis) to be pierced. However, it seems too early to go long. Model portfolio is neutral.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as the bond trading signals. Currently available.

GH Garrett – Veteran Commodity Watcher for Conquer the Mummy .com “Nonlinear signals that matter in gold trading.”