Oct-Nov Rotations: Core Mkt = Wheat, Featured Mkt = Crude.

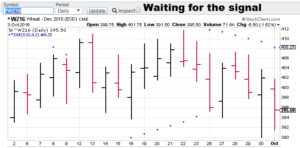

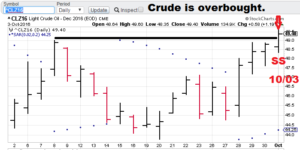

Signals: WZ = Flat (TSP= NA), CLZ= Sell 10/03 (TSP= waiting).

Model notes: CTM is back tracking select markets. The hiatus is over and it is time to get back to it. We lead off with a crude sell. The wheat is still flat and we are waiting for a signal for the grain.

Note: The TSP (theoretical Signal Price) metric is calculated by using the ‘close’ price of the trading day FOLLOWING the signal day (giving you plenty of time to take the signal).

Note: The following comments are based on using technical analysis to ‘flesh out’ our nonlinear trading signals.

Nonlinear Trading Themes:

Wheat Trading Signals (Core). Wheat is bouncing around the $3.90 to $4.10 range. The models are not giving the edge to either the bulls are the bears. We are near the low end of the monthly range but the readings are not giving us further guidance. Patience is the watch word, the Mummy stays flat.

Wheat Trading Signals (Core). Wheat is bouncing around the $3.90 to $4.10 range. The models are not giving the edge to either the bulls are the bears. We are near the low end of the monthly range but the readings are not giving us further guidance. Patience is the watch word, the Mummy stays flat. Crude (Featured). This is an exciting opportunity for us as I used to do work for another website (EnergyTrendAlert.com, under the Joseph Grain Company) tracking energy price signals. Now I return using a different and more exciting technology. The models gave us a sell based on today’s close. Crude is at the high end of the monthly range and the models are signaling instability ahead. The Mummy sees lower prices ahead!

Crude (Featured). This is an exciting opportunity for us as I used to do work for another website (EnergyTrendAlert.com, under the Joseph Grain Company) tracking energy price signals. Now I return using a different and more exciting technology. The models gave us a sell based on today’s close. Crude is at the high end of the monthly range and the models are signaling instability ahead. The Mummy sees lower prices ahead!

Premium Research notes:

Observation: Don’t sit around your Monday morning meetings giving each other high-fives with a two-star fund or strategy on the books. Contact me for more info. Click the ‘Ranking’ tab to find out additional info. By the way, in 2016, I am only going to take on 6 clients. CTM can help and our rates are reasonable!

We are now offering asset class ranking (or alternatively sector ranking), using our trading signal technology on a longer timeframe. This is an exciting new product as portfolio construction has one glaring, missing puzzle piece: what asset classes will continue to outperform/advance for next month? Get your independent research here, put my 25+ years of model building experience to work for you!

Take a minute to peruse the US Equities tab. I posted the S&P 500 trading signals postmortem for the recent March-April time period (approx. as it took about a week to generate a signal at the beginning). Plus 134 Points. Great stuff!

Take a minute to check out the Forex tab on our website. I am posting the recent US Dollar May-June signals. No whipsaws and playing the surprise Brexit vote just right. Great stuff!

Take a minute to take a minute to click on our bond trading tab. Our signals took the profits in the early month while holding the long interest rates position later. It never sold rates, hinting at higher rates to come. The TBT went higher outside our test window. A nice tip-off for the future!

GH Garrett – Chief Market Analyst for ConquertheMummy.com © 2015-2016, “Nonlinear trading signals that matter in gold (and crude) trading.”