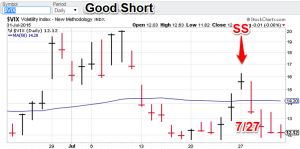

Model Portfolios: Gold = Flat/exit long 7/27 (formerly bullish 6/04), S&P 500= Buys 7/27 (was flat from 6/09!), VIX= Sells 7/27 (finally!).

System Note: Version 2.0(S) had a really good week. The inaugural positions had a great first week with $VIX and $SPX moving solidly in the direction of their respective signals. The GLD signal was to “flat” (nontrending) and Monday’s close was practically at the same level as Friday’s. So all three of the target markets were called successfully!

Nonlinear Trading Themes:

Gold: The yellow metal traded with extreme lackluster this week. Friday’s close posted less than 10 cents away from Monday’s. With indications of a strengthening stock market gold may have more to come. The gold model portfolio is still flat.

Gold: The yellow metal traded with extreme lackluster this week. Friday’s close posted less than 10 cents away from Monday’s. With indications of a strengthening stock market gold may have more to come. The gold model portfolio is still flat. S&P 500: The S&P 500 powered higher after the buy signal. Tuesday’s intraday action featured a nice selloff to allow entry into bullish side before the market closed higher. Indications are for more strength ahead. The S&P 500 portfolio is still bullish.

S&P 500: The S&P 500 powered higher after the buy signal. Tuesday’s intraday action featured a nice selloff to allow entry into bullish side before the market closed higher. Indications are for more strength ahead. The S&P 500 portfolio is still bullish. $VIX (S&P volatility): Volatility (AKA the ‘fear index”) did not fare well with stocks rising. Price support at the 12 level will be hard pressed to hold with the uptrend in largecap equities. The Vix model portfolio remains short.

$VIX (S&P volatility): Volatility (AKA the ‘fear index”) did not fare well with stocks rising. Price support at the 12 level will be hard pressed to hold with the uptrend in largecap equities. The Vix model portfolio remains short.

Note: Technical comments are based on interpretations of non-linear trading models, combined with chart price action.

Premium offers:

- Bond Trading Signals. I am offering a similar Mummy process for Treasuries. See the “Bond Trading Signals” tab for more info. Currently available.

- Currency Trading Signals. I am now offering a similar Mummy process for currencies. This service will involve two signal paths, one on the US dollar and the other on a user selected second currency (1+1).The fee will be the same as the Bond trading signals.

GH Garrett – Veteran Commodity Watcher for ConquertheMummy.com © 2015, “Nonlinear signals that matter in gold trading.”